LONG-TERM APPROACH

Because time matters more than timing

At Capital Group, home of American Funds, we follow a long-term approach because we believe it’s the best way to help investors achieve their financial goals

Whether it’s saving for college, retirement or a house, nothing happens overnight. Our commitment to long-term investing takes many forms, and our culture and system reinforce them all.

Long term means it pays to put in the time

Our investment professionals’ compensation is tied to short-, medium- and long-term results, with a greater focus on the long term*

Why is that important? Because longer measurement periods mean more time for well-researched, high-conviction investments to perform well. Because they have time to build results, our investment professionals seek to avoid taking outsized risks in pursuit of short-term results.

As of December 31, 2023.

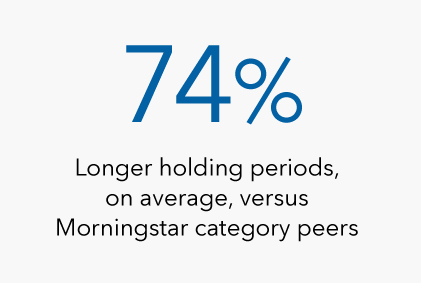

On average, the equity-focused American Funds hold their investments for 3.3 years, whereas their peers hold their investments for 1.9 years, based on the equal-weighted blended averages across each of the 20 equity-focused American Funds’ respective Morningstar categories. Please see the bottom of the page for a list of each fund’s respective Morningstar category.

Long term means experience

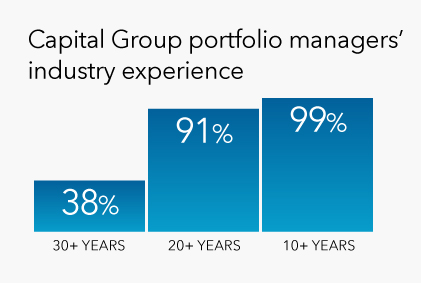

Nearly all of our portfolio managers have more than 10 years of industry experience

Nearly nine out of 10 have at least 20 years in the industry, and more than a third have over three decades of experience.

As of December 31, 2023.

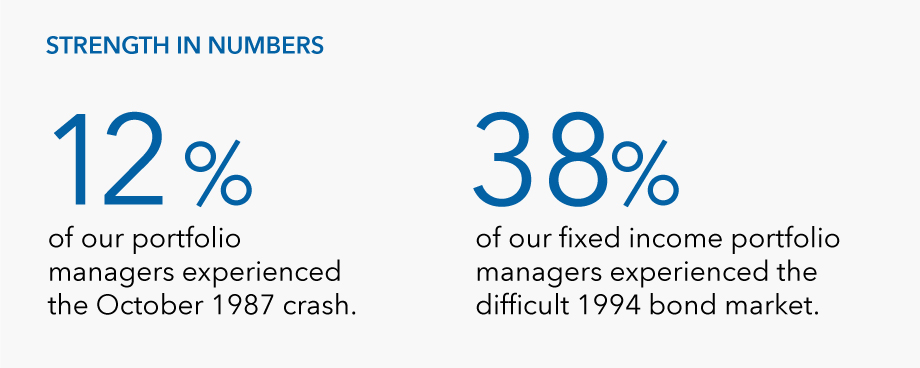

Many of our portfolio managers have experienced multiple market crises and have kept cool heads during bumpy rides.

As of December 31, 2023.

Long term means there is power in being private

At public companies, quarterly profits often drive short-term thinking

Capital Group is a privately held firm. So rather than being distracted by what’s good for "the Street," we can focus on what’s best for long-term investors. We believe that being privately held for 93 years has helped maintain our investor-focused culture.

Long term means prioritizing long-term, superior results

Our long-term thinking has gotten results for our investors for 93 years

We have managed multiple investment strategies through various investment vehicles. And while investment results vary, the equity-focused American Funds have generated strong results versus peers, with our funds having beaten their Lipper peer indexes in 81% of 10-year periods and 95% of 20-year periods as of December 31, 2023.†

Our beliefs

Your goals power ours

We have four core beliefs central to helping you succeed.

More beliefs

THE CAPITAL SYSTEM

PARTNERSHIP AND SUPPORT

Build a more personal portfolio.

Your clients need portfolios as individual as they are. Our portfolio construction approach lets you customize a mix that works with the individual goals of your clients.

* Compensation paid to our investment professionals is heavily influenced by results over one-, three-, five- and eight-year periods, with increasing weight placed on each succeeding measurement period to encourage a long-term investment approach.

† Based on Class F-2 share results for rolling monthly 10- and 20-year periods starting with the first 10- or 20-year period after each mutual fund's inception through December 31, 2023. Periods covered are the shorter of the fund’s lifetime or since the comparable Lipper index inception date (except Capital Income Builder and SMALLCAP World Fund, for which the Lipper average was used). Expenses differ for each share class, so results will vary. Past results are not predictive of results in future periods.

American Funds Morningstar categories: The peer groups against which we compare the American Funds in these charts reflect the averages of the relevant Morningstar U.S. Active Fund categories. The 20 equity-focused American Funds used in our analysis and their relevant Morningstar U.S. Active Fund categories with which they were compared are as follows: AMCAP Fund®, The Growth Fund of America® (Large Growth); American Mutual Fund® (Large Value); Fundamental Investors®, The Investment Company of America®, Washington Mutual Investors Fund (Large Blend); American Balanced Fund® (Allocation--50% to 70% Equity); Capital Income Builder®, American Funds® Global Balanced Fund (Global Allocation); The Income Fund of America® (Allocation--70% to 85% Equity); The New Economy Fund®, New Perspective Fund® (Global Large-Stock Growth); Capital World Growth and Income Fund®, American Funds® Global Insight Fund (Global Large-Stock Blend); New World Fund®, American Funds® Developing World Growth and Income Fund (Diversified Emerging Markets); EuroPacific Growth Fund®, American Funds® International Vantage Fund (Foreign Large Growth); SMALLCAP World Fund® (World Small/Mid Stock); and International Growth and Income Fund (Foreign Large Blend).

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates.

This content is published by Capital Client Group, Inc., and copyrighted to Capital Group and affiliates, 2025, all rights reserved.

For more information, including our detailed disclosures, visit www.capitalgroup.com/global-disclosures.