RESEARCH

When we invest in companies, we want to know them from break room to boardroom.

Our deep and fundamental research is the backbone of our company and essential to delivering superior outcomes to our investors.

We pioneered industry standards.

In the early days of Capital Group, home of American Funds, there was very little stock market or economic information readily available to investors.

So Capital Group's early leaders researched and documented the information. These leaders used their statistical backgrounds along with various information sources when evaluating companies.

By the 1960s, Capital Group had become a global investing trailblazer, investing in companies outside the U.S. Yet again, we found that statistical information and investment data for non-U.S. markets were scarce.

So we created the Capital International indexes, now known as the Morgan Stanley Capital International (MSCI) indexes, to help evaluate companies and compare their results with global competitors. In other words, we put the CI in MSCI.

Today, we maintain our high standards as we evaluate the depth and breadth of a company. But we know that numbers are only part of the picture.

We’ve got boots on the ground.

We believe that the best way to get to know a company is to know the people behind the business.

That’s why, when we research companies, it’s much more than a site visit. We want to know both upper management and the employees on the ground.

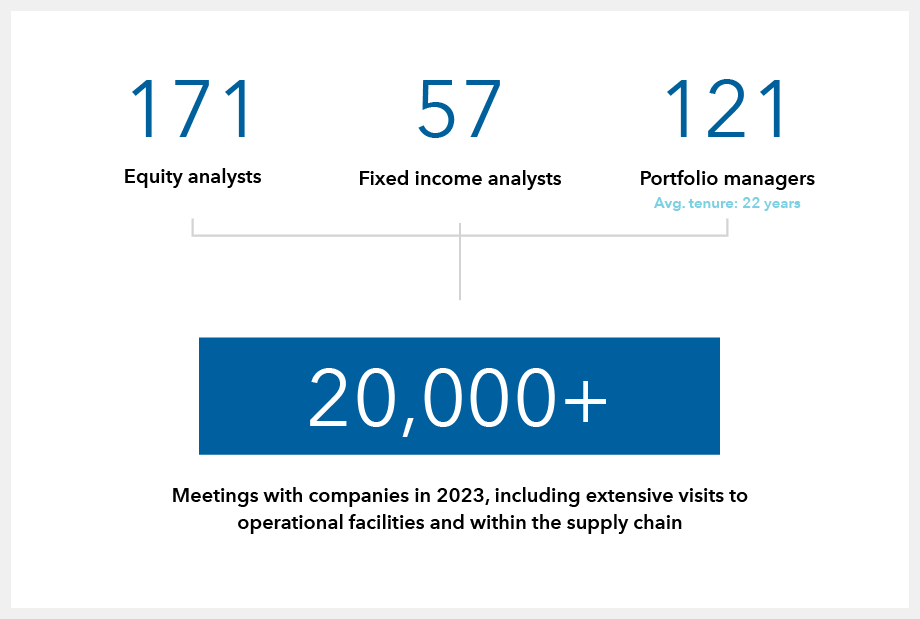

Our equity analysts also collaborate with our fixed income analysts, who draw on deep research across sectors, including rates, credit, mortgages and currencies.

Meetings are essential to our research. Our investment professionals conducted more than 20,000 meetings with companies in 2023.

All data as of December 31, 2023.

One of our investment professionals has been covering Mattel for so long that he may know the business culture better than many of its former leaders. As Greg Wendt, a Capital Group portfolio manager explains,

“Continuity of coverage can provide a significant advantage in evaluating management. At this point, I have covered Mattel through seven CEOs and for over 30 years, which is longer than the current CEO has been in the toy business.”

We also believe that it’s the management team behind a company that drives its success, which makes our face-to-face research invaluable. As one of our leaders said in the early days of our business, “The only difference between Chrysler Corporation and its predecessor [the struggling Maxwell Motor Company] is Walter Chrysler.”

We get a world of context.

Information isn’t useful in a vacuum. We need to know how industries in different regions compare to each other in order to deeply understand the companies themselves.

For example, to understand companies in the steel industry in the U.S., investors must have insight into the steel industry in Europe, Japan and China.

At Capital Group, we have a global research team with extensive scale and scope, covering both equity and fixed income investing. With 48% of our portfolio managers and analysts living outside the U.S. in cities like Geneva, London, Tokyo, Singapore, Mumbai, Shanghai and Hong Kong, we can closely follow trade and other global issues like few others can.

When it comes to our research team, these are the numbers to know:

Source: Capital Group. As of December 31, 2023.

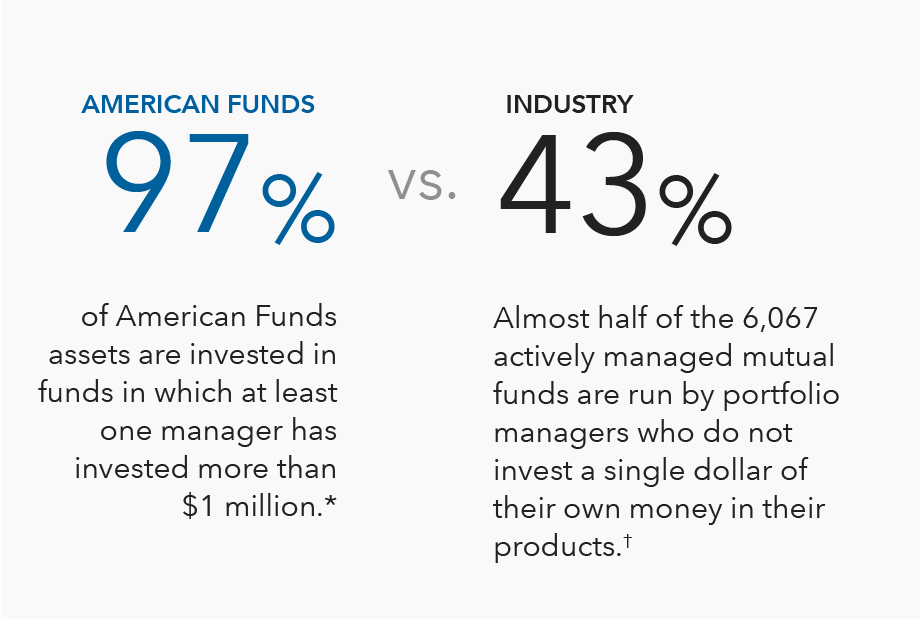

We put our money where our mouth is.

Nearly all of our portfolio managers are invested in the funds they manage.

* Source: Morningstar. As of 2/15/24.

†Capital Group, based on Morningstar data as of 2/15/24. All funds included in the analysis are non-index (active funds), based on oldest share class. Manager ownership information classified as "inconsistent" by Morningstar is not included. If fund liquidated or merged, this information is as of the latest Statement of Additional Information.

We take the time to do it right.

Our research is too important for shortcuts.

Our fundamental, research-driven approach, the relationships we’ve built over decades and our extensive global research effort allow us to invest confidently.

Our beliefs

Your goals power ours

We have four core beliefs central to helping you succeed.

More beliefs

THE CAPITAL SYSTEM

LONG-TERM APPROACH

PARTNERSHIP AND SUPPORT

Build a more personal portfolio.

Your clients need portfolios as individual as they are. Our portfolio construction approach lets you customize a mix that works with the individual goals of your clients.