A thought ran through my head as I stood on a crowded New York City commuter train last October and saw no one wearing a mask: ‘COVID is over.' But as one who manages an investment portfolio for retirement plans, I see the effects of the pandemic everywhere, and I believe we’ll be living with its implications for many years to come. I think of it as the pandemic decade.

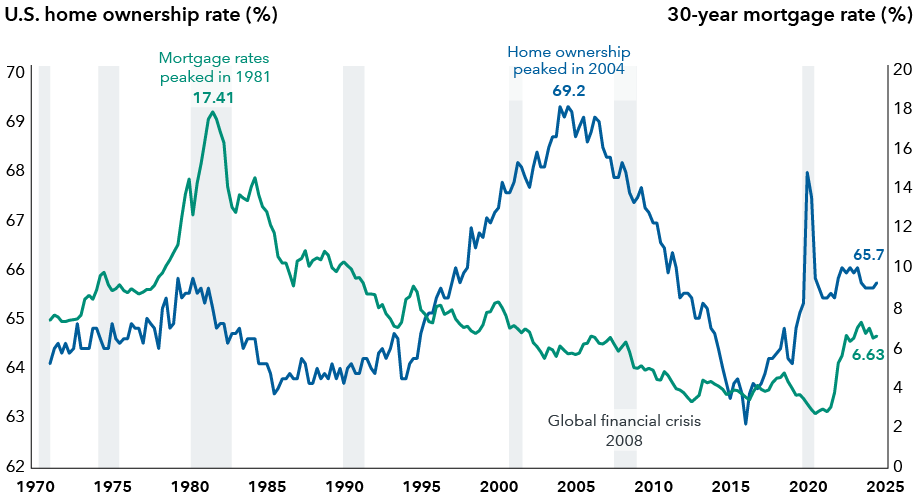

The pandemic continues to ripple through different industries, has set economic cycles off-kilter, caused bank failures, and drives many of today’s global conflicts in my view.

Different life cycles for products and systems mean the echoes of COVID-19 could linger for a decade — perhaps even a generation. For instance, the length of a commercial real estate loan is usually 10 years, and business travel has not returned to past levels.

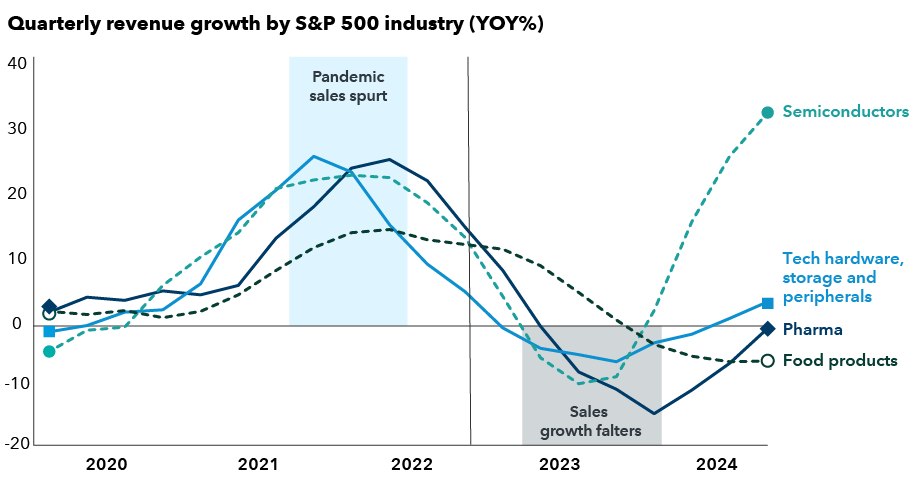

COVID-19 kick-started a roller coaster of booms and busts less correlated to the typical economic cycle. As a result, relying on past economic patterns may be misleading. With that backdrop, here are five thoughts on how I believe the pandemic has affected the investment landscape, and how I’m sizing up implications in portfolios I manage for both growth and dividend-paying equities.