Glossary

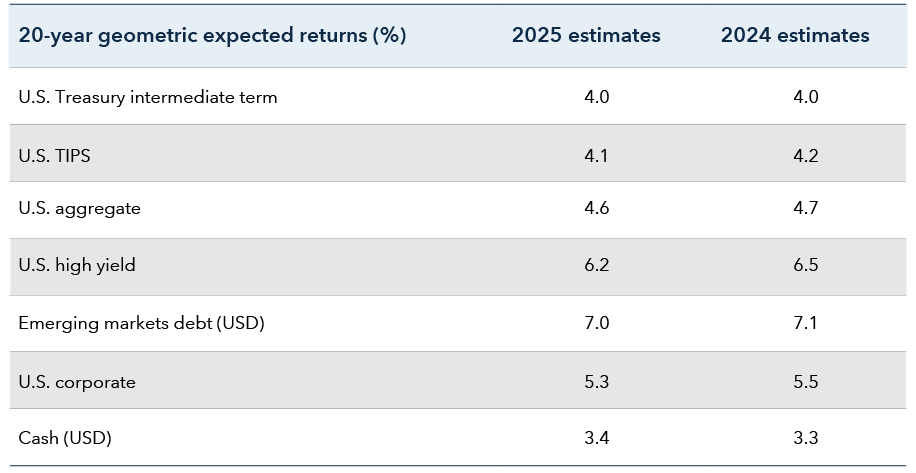

Capital market assumptions: Long-term projections of the future performance of asset class returns based on their respective benchmark indexes that incorporate analysis and observations.

Duration: The measurement of the sensitivity of the price of a bond or debt instrument to the change in interest rates. The higher the duration, the more a bond’s price will drop as interest rates rise (and the greater the interest rate risk).

Magnificent Seven: The seven largest contributors to returns in the S&P 500 in 2023. The companies are Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

Mean reversion: The assumption that an asset’s price will tend to converge with its average price over time, despite long-term variations.

Multiple: A way of assessing the value of a company by comparing it to peers, usually by a ratio. This helps to quantify a company's health and find investment opportunities.

Option-adjusted spread: A yield-spread calculation used to value securities with embedded options.

Price-to-earnings (P/E): The ratio for valuing a company that measures its current share price relative to its earnings per share (EPS).

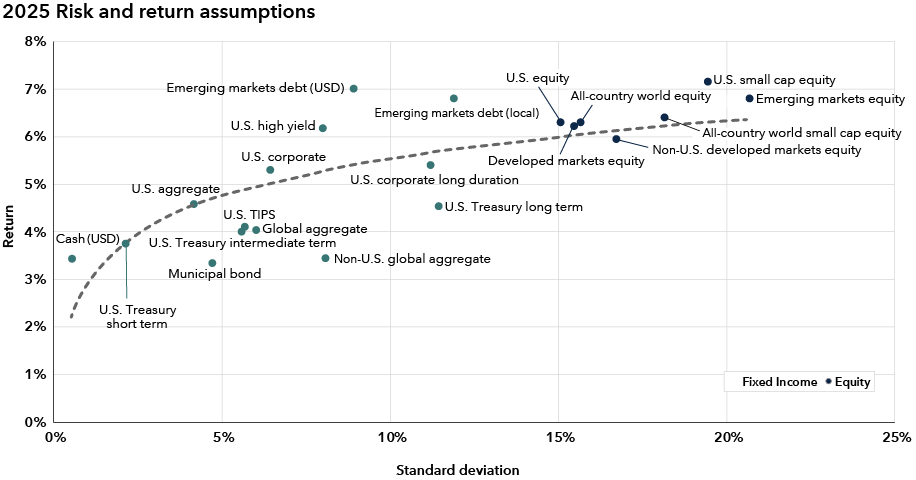

Standard deviation: A statistical measure of dispersion of the observed return that depicts how widely a stock or portfolio’s returns varied over a certain period of time. When a stock or portfolio has a high standard deviation, the predicted range of performance is wide, implying greater volatility.

Value trap: A stock that appears to be valued attractively but ultimately fails to provide outsized gains for investors.

Yield curve: An illustration of the yields on similar bonds across various maturities. An inverted yield curve occurs when yields on short-term bonds are higher than yields on long-term bonds. Yield curve steepening occurs when long-term rates rise more than short-term rates, or short-term rates fall more than long-term rates.

Asset classes and benchmark index definitions

All indexes are unmanaged.

Cash (USD): The FTSE 3-Month U.S. T-Bill Index Series is intended to track the daily performance of three-month U.S. Treasury bills. The indexes are designed to operate as a reference rate for a series of funds.

U.S. Treasury short term: The Bloomberg 1–5 Year U.S. Treasury Index measures USD-denominated, fixed-rate, nominal debt issued by the U.S. Treasury with maturities of one to five years.

U.S. Treasury intermediate term: The Bloomberg 5–10 Year U.S. Treasury Index measures USD-denominated, fixed-rate, nominal debt issued by the U.S. Treasury with maturities of five to 10 years.

U.S. Treasury long term: The Bloomberg 10–20 Year U.S. Treasury Index measures USD-denominated, fixed-rate, nominal debt issued by the U.S. Treasury with maturities of 10 to 20 years. The Bloomberg 20+ Year U.S. Treasury Index measures USD-denominated, fixed-rate, nominal debt issued by the U.S. Treasury with maturities of 20 years or more.

U.S. TIPS: The Bloomberg U.S. Treasury Inflation-Protected Securities (TIPS) Index consists of investment-grade, fixed-rate, publicly placed, USD-denominated and non-convertible inflation-protected securities issued by the U.S. Treasury that have at least one year remaining to maturity and $250 million par amount outstanding.

U.S. aggregate: The Bloomberg U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market.

U.S. corporate: The Bloomberg U.S. Corporate Investment Grade Index represents the universe of investment-grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity and quality requirements.

U.S. corporate long duration: The Bloomberg U.S. 20+ Year AAA-A Corporate Bond Liquid Index measures fixed-rate, taxable corporate bonds with at least 20 years remaining to maturity. It includes USD-denominated securities issued by U.S. and non-U.S. industrial, utility and financial issuers with an index rating of at least AAA and at least $750 million par amount outstanding and excludes subordinated debt.

U.S. high yield: The Bloomberg U.S. Corporate High Yield Index 2% Issuer Cap covers the universe of fixed-rate, non-investment-grade debt. The index limits the maximum exposure of any one issuer to 2%.

Non-U.S. global aggregate: The Bloomberg Global Aggregate ex-USD Index measures the performance of global investment-grade bonds, excluding the United States. This multicurrency benchmark includes Treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging market issuers.

Global aggregate: The Bloomberg Global Aggregate Bond Index measures the performance of global investment-grade bonds. This multicurrency benchmark includes Treasury, government-related, corporate and securitized fixed-rate bonds from both developed and emerging market issuers.

Emerging markets debt (USD): The J.P. Morgan Emerging Market Bond Index (EMBI) Global Diversified is a uniquely weighted emerging markets debt benchmark that tracks total returns for USD-denominated bonds issued by emerging market sovereign and quasi-sovereign entities.

Emerging markets debt (local): The J.P. Morgan Government Bond Index — Emerging Markets (GBI-EM) Global Diversified covers the universe of regularly traded, liquid fixed-rate, domestic-currency emerging markets government bonds to which international investors can gain exposure.

Municipal bonds: The Bloomberg Municipal Bond Index is a market-value-weighted index designed to represent the long-term investment-grade tax-exempt bond market.

U.S. equity: The MSCI USA Index is a free-float-adjusted, market-capitalization-weighted index that measures the U.S. portion of the world market. Results reflect dividends gross of withholding taxes.

U.S. small-cap equity: The MSCI USA Small Cap Index is a free-float-adjusted, market-capitalization-weighted index that measures the performance of the small-cap segment of U.S. markets.

Developed markets equity: The MSCI World Index is a free-float-adjusted, market-capitalization-weighted index that measures equity market results in developed global markets, consisting of 23 developed market country indexes.

All-country world equity: The MSCI All Country World Index (ACWI) is a free-float-adjusted, market-capitalization-weighted index that measures equity market results in global developed and emerging markets, consisting of more than 40 developed and emerging markets country indexes.

All-country world small-cap equity: The MSCI All Country World Small Cap Index is a free-float-adjusted, market-capitalization-weighted index that measures equity market results of smaller capitalization companies in both developed and emerging markets. Results reflect dividends net of withholding taxes.

Non-U.S. developed markets equity: The MSCI World ex USA Index is a free-float-adjusted, market-capitalization-weighted index that measures equity market results in global developed markets, consisting of 22 of 23 developed market country indexes, excluding the United States.

Emerging markets equity: The MSCI Emerging Markets Index is a free-float-adjusted, market-capitalization-weighted index that measures equity market performance of emerging markets.

Agency mortgage-backed securities: The Bloomberg U.S. Mortgage-Backed Securities Index measures a market-value-weighted index that covers fixed-rate, publicly placed, dollar-denominated obligations issued by the U.S. Treasury, U.S. government agencies, quasi-federal corporations, corporate or foreign debt guaranteed by the U.S. government, and the mortgage-backed pass-through securities of Federal National Mortgage Association, the Federal Home Loan Mortgage Corporation and the Government National Mortgage Association.

Important Information

This analysis represents the views of a small group of investment professionals based on their individual research and are approved by the Capital Market Assumptions Oversight Committee. They should not be interpreted as the view of Capital Group as a whole. As Capital Group employs The Capital System, the views of other individual analysts and portfolio managers may differ from those presented here. They are provided for informational purposes only and are not intended to provide any assurance or promise of actual returns. They reflect long-term projections of asset class returns and are based on the respective benchmark indices, and therefore do not include any outperformance gain or loss that may result from active portfolio management. Note that the actual results will be affected by any adjustments to the mix of asset classes. All market forecasts are subject to a wide margin of error.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor’s, Moody’s and/or Fitch, as an indication of an issuer’s creditworthiness.

Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

While not directly correlated to changes in interest rates, the values of inflation linked bonds generally fluctuate in response to changes in real interest rates and may experience greater losses than other debt securities with similar durations.

Bloomberg® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2025. FTSE Russell is a trading name of certain of the LSE Group companies. FTSE® and Russell® are trademarks of the relevant LSE Group companies and are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

This report, and any product, index or fund referred to herein, is not sponsored, endorsed or promoted in any way by J.P. Morgan or any of its affiliates who provide no warranties whatsoever, express or implied, and shall have no liability to any prospective investor, in connection with this report. J.P. Morgan disclaimer: https://www.Jpmm.com/research/disclosures.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2025 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.