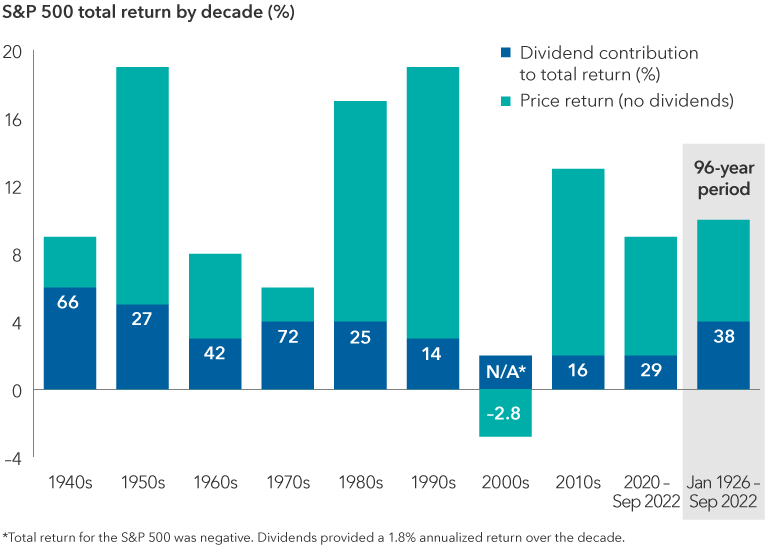

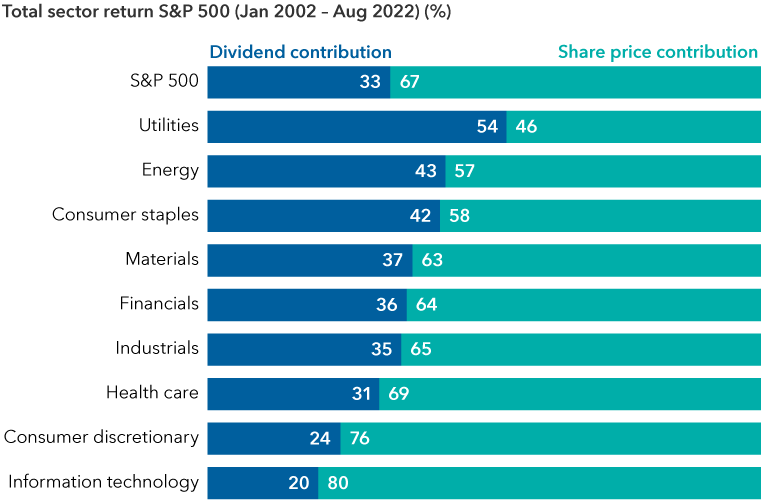

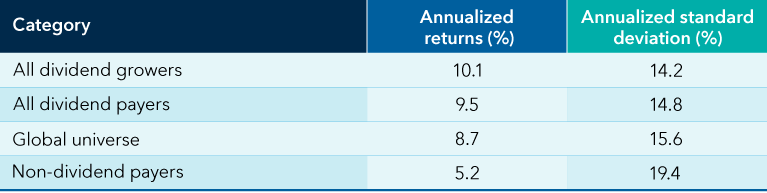

The market pivot away from growth stocks over the past year has brought the dividend component of total stock returns back into focus. Dividend payers in the S&P 500 Index have outpaced the broader market by a significant margin over the past 12 months. With the U.S. Federal Reserve intent on tightening monetary policy to contain inflation, investors will likely continue to be less willing to pay up for high-multiple stocks, and dividends should remain in focus.

We asked two of our portfolio managers who have experience managing strategies with a focus on dividends and preservation of capital to share their thoughts. Alan Berro, principal investment officer (PIO) of Washington Mutual Investors FundSM, and Will Robbins, PIO of American Mutual Fund®, discuss how they are navigating the current investing environment and offer their medium-term outlook.