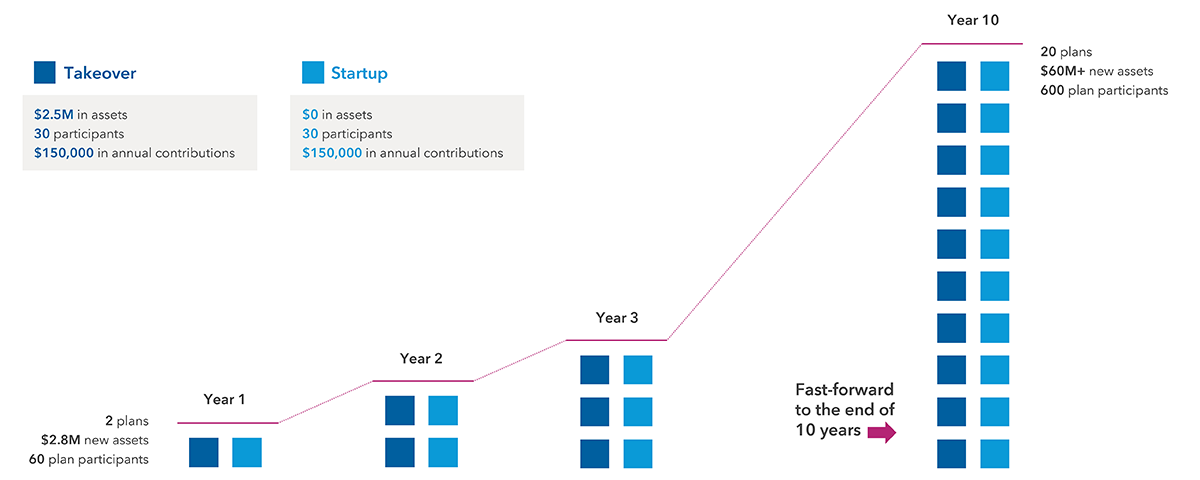

Forward-looking financial professionals are focusing on the convergence of wealth management and retirement plan business.

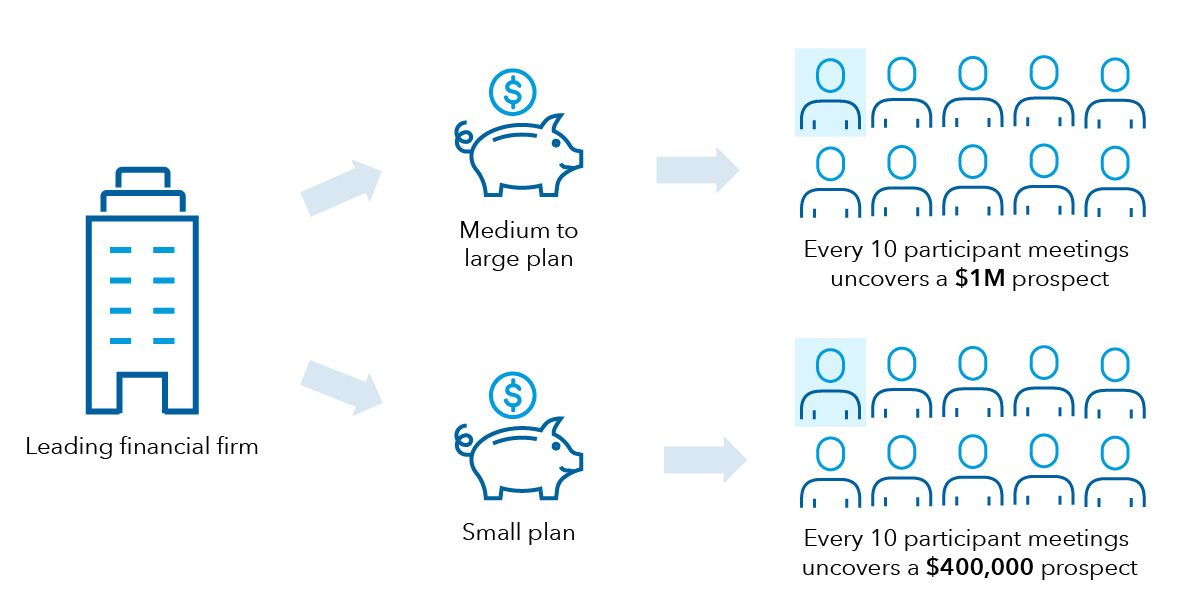

In early 2024, a Capital Group benchmarking study showed that high-growth financial professionals were more likely to have 25% or more of assets under management (AUM) in defined contribution plans. They were also 23% more likely to have a strategy for transitioning plan participants into prospects for their practice.

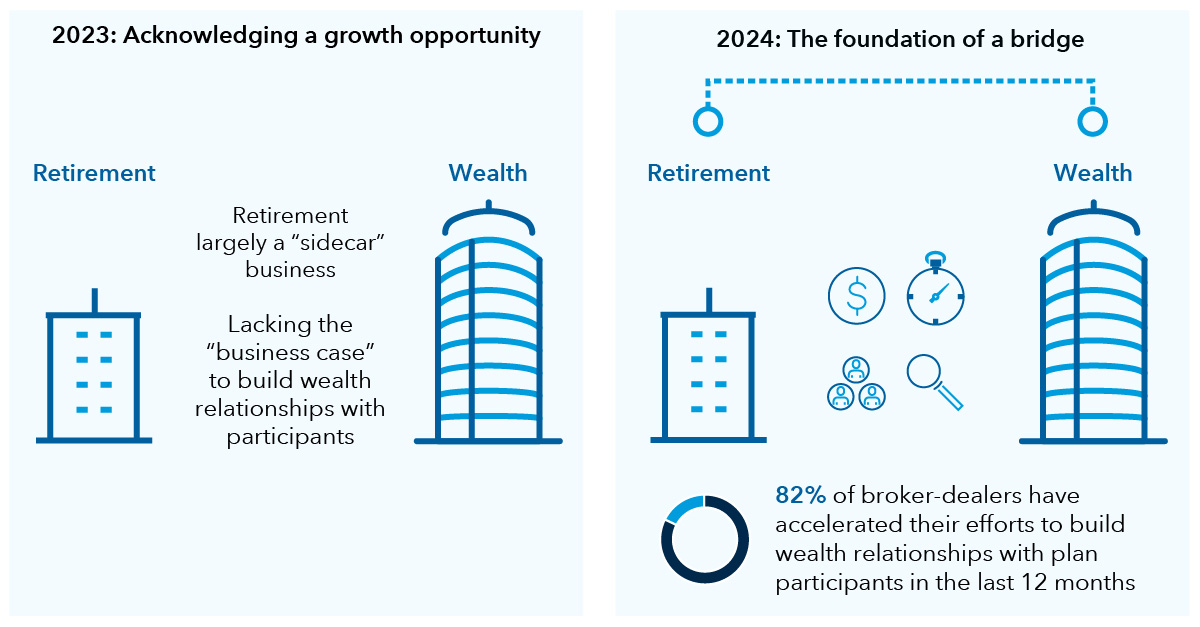

Following that report, in June 2024, Capital Group hosted and sponsored the Retirement Leadership Forum for its top broker-dealer partners. There, executives from 15 firms confirmed that a focus on converging wealth and retirement plans is key. Eighty-two percent of firms have accelerated their efforts to build wealth relationships with plan participants in 2024. This is a marked shift from 2023, when retirement plans were largely considered a “sidecar” business.