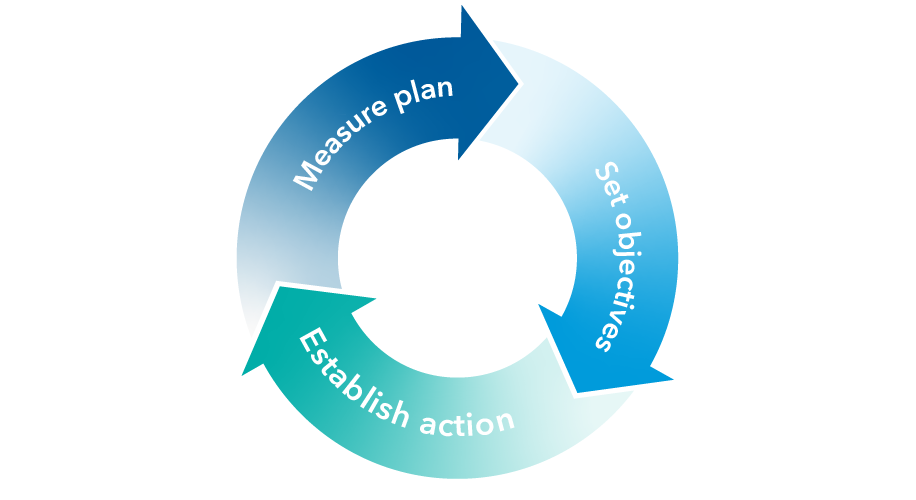

To be successful, plan sponsors must address a few key questions about their plans:

- What are our success metrics?

- How do we measure against them?

- What are we doing to improve?

With clear objectives, regular measurement and strategic adjustments, a plan sponsor has the tools to influence participant outcomes.

Success metrics

Focus on three key metrics and action steps to gauge your plan’s success. Note that each plan should develop its own set of goals.