In the world of sports, the role of a coach is instrumental in shaping the mindset, strategy – and ultimately – the success of athletes. For financial professionals, strategizing what is best for your clients can often feel like a high-stakes game. Yet, as any seasoned coach might tell you, success lies in the fundamentals and the incremental victories.

Adding retirement plans to your wealth management practice can help grow your business. “Winning is not a sometime thing; it’s an all the time thing," revered football coach Vince Lombardi once said. This mindset is crucial for financial professionals who are considering adding (more) retirement plans to their wealth management practice.

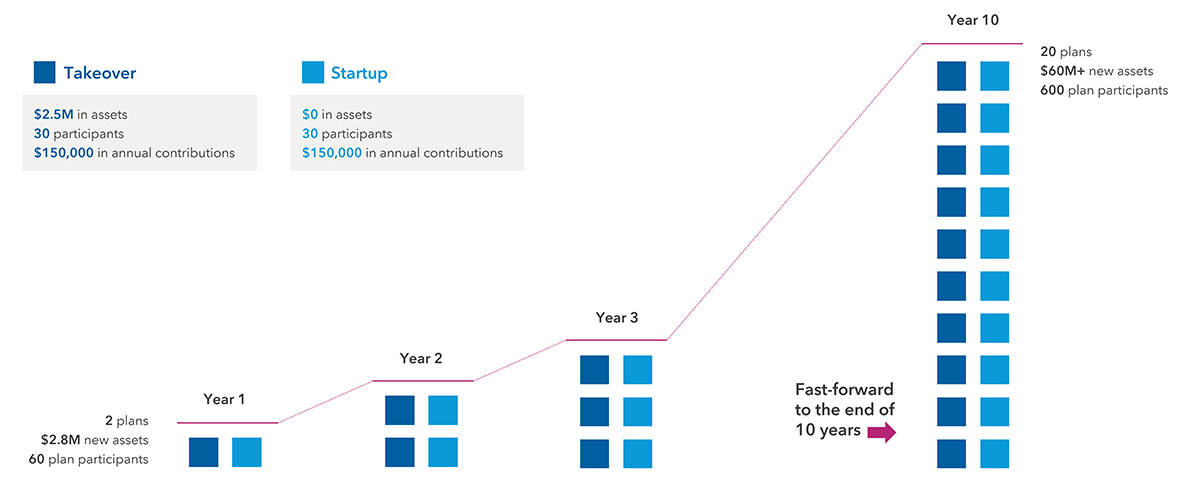

Imagine focusing your strategy on winning just two retirement plans a year. With each plan hosting 30 participants, by the end of a decade, you could be guiding the futures of 600 new plan participants. In this hypothetical example, that could potentially equate to an added $60+ million in assets. This long-term, incremental approach may be one of the fastest ways to increase your assets under management.