Chart in Focus

Portfolio Construction

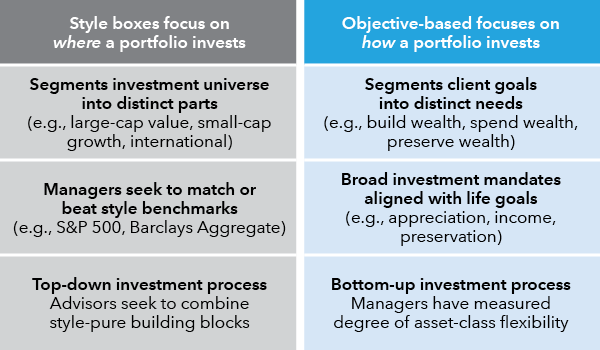

- Objective-based strategies emphasize investment objectives such as appreciation, income or preservation that align clearly with client goals.

- Objective-based investing focuses on investment strategy (how to invest), while traditional style-box frameworks define the investment universe (where to invest).

- A case study of the American Funds family illustrates that objective-based strategies could have produced differentiated, and improved, investor outcomes compared to style-based indexes.

- Advisors who vary the amount of equities to match a client's risk tolerance, can use investment objectives to vary the type of equities to fit client goals.

- Objective-based portfolios may be simpler for clients to understand, potentially improving savings, spending and investment behavior.

Financial professionals face several new challenges today. New fiduciary standards have prompted many advisors to revisit portfolio construction, to ensure that investments match client goals. At the same time unprecedented product proliferation has increased the complexity of portfolios, making it difficult to translate them to clients. We think objective-based investing can help; this article describes how.

Objective-based strategies align to client goals

Objective-based strategies emphasize investment objectives that align to client goals in order to drive the investment decisions. Objectives such as growth of capital, or current income, or preservation of principal serve to distill specific client needs when building wealth (e.g. college savings) or spending wealth (e.g. retirement) or conserving wealth. They also provide general investment guidelines for portfolio managers. These strategies are intuitively appealing, and have a long investment pedigree. Yet the focus on investor goals leads to several differences from style-box approaches that are commonly used today.

First, style-based strategies are defined based on a specific investment universe, and tend to align to asset classes or style boxes. In contrast, objective-based strategies are defined by their investment strategy, and tend to align with client goals. Styles thus focus on where to invest, while objectives specify how to invest.

Second, style-oriented funds seek to find the best securities within their investment universe and often focus solely on outperforming the style index or peer-group benchmark. Objective-based also seek attractive returns, but tend to also emphasize broader investment objectives such as appreciation, income, preservation, or a combination thereof.

Finally, asset allocation in a style-based approach is generally prescriptive with specific asset-class targets. In an objective-based approach there is instead a reasonable tolerance around asset-class targets that allows portfolio managers a measured degree of flexibility. A growth-style fund will typically restrict investments to stocks classified by index providers as “growth” (usually stocks with high historical earnings growth, or high price/earnings ratios). In contrast a fund focused on the objective of growth seeks capital appreciation, and may invest in a wider set of companies including those classified as “value” (usually stocks with low price/earnings ratios), depending on opportunities and any restrictive investment policies.

Differentiated characteristics can lead to improved client outcomes

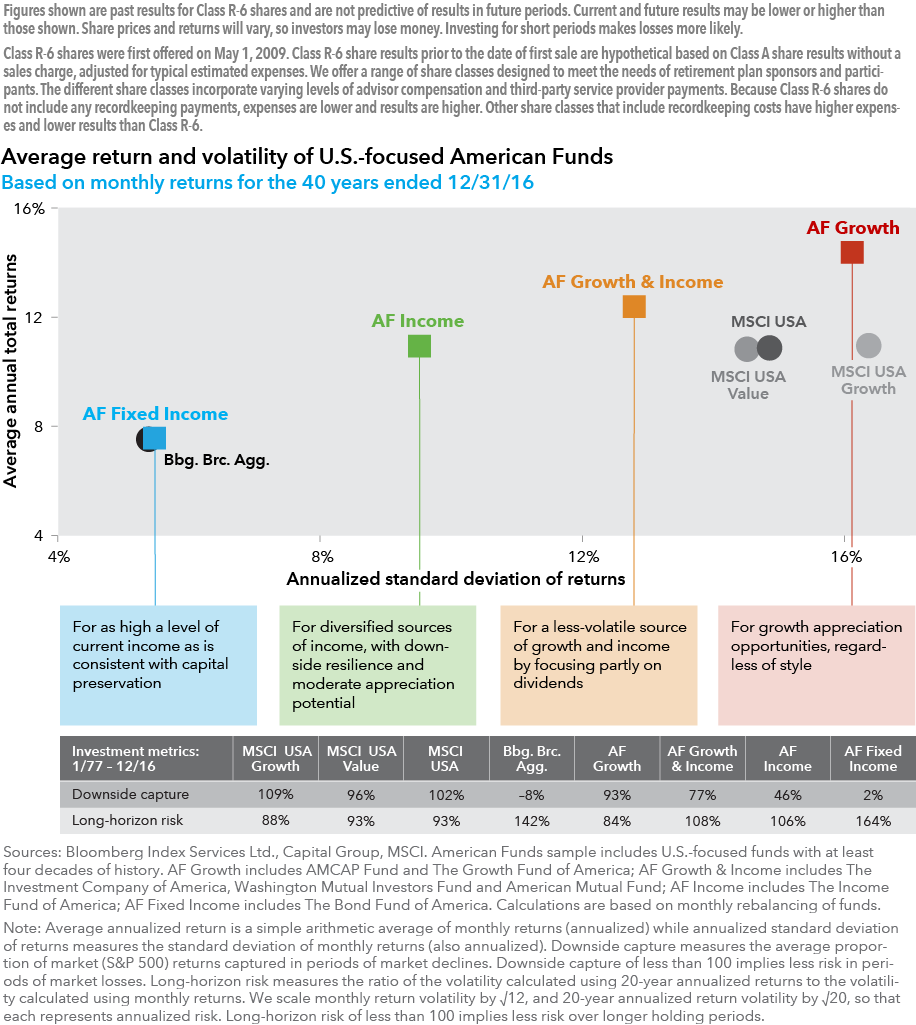

We consider a case study of the American Funds family to illustrate how investment objectives can influence long-term risk and return. We evaluate funds with objectives of growth, growth and income, equity income and fixed income respectively over a 40-year period ending December 2016. Each category is represented by an equal-weighted portfolio of all U.S.-focused American Funds that go back to 1977. The chart below contrasts the average returns and volatilities of objective-based strategies with those of style indexes from MSCI and Barclays Bloomberg that offer similar long-term data. MSCI USA and Bloomberg Barclays Bond Index represent the returns of the broad U.S equity and bond markets respectively. MSCI USA Value and MSCI USA Growth Indexes break out U.S equity market returns into those for value-style companies, and growth-style companies respectively, as defined by MSCI.

View fund expense ratios and returns.

We find that investment objectives have yielded differentiated return-volatility profiles over the 40-year period: the growth-objective strategies had significantly higher returns than the style indexes, and the income-objective strategies have had significantly lower volatility. In contrast, the equity-style indexes cluster together, with very similar long-term return and volatility. In addition to calculating results over the 40-year study period, we also evaluate rolling three-year periods to explore how the characteristics of style indexes change through time. The MSCI USA Growth style index would have had lower return than the broad MSCI USA index in 49% of rolling three-year periods, while the MSCI USA Value style index would have had more volatility than MSCI USA in 33% of such periods.

Importantly for goals-based investors, the objective-based strategies had differentiated results during declining markets, and across different holding periods. Income-oriented strategies had low downside capture illustrating more resilience in periods of market stress. In contrast, growth-objective strategies had low long-horizon risk, illustrating that monthly volatility tended to smooth out over rolling 20-year holding periods. These characteristics can be quite valuable in mitigating risks that clients face across their life.

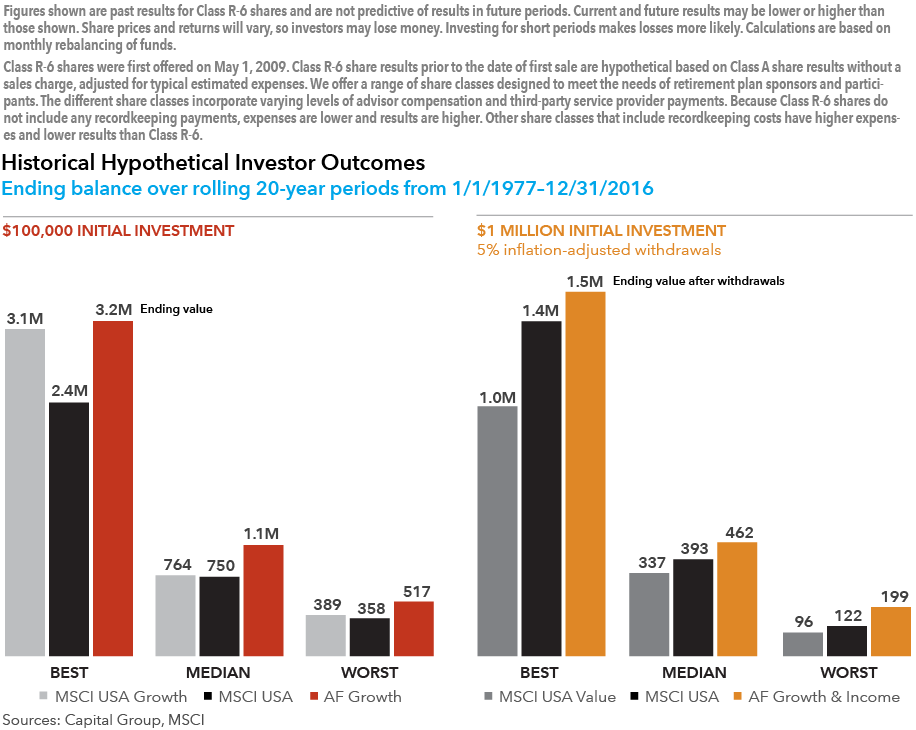

Consider a worker who makes a $100,000 investment toward his retirement 20 years from now. In the left chart of the exhibit below we calculate accumulated savings from investing the MSCI USA Index and MSCI USA Growth style index, compared to the AF Growth objective strategies, at the end of every rolling 20-year period from 1977 – 2016. An investment in the growth-objective strategies would have yielded a nest egg of $1.1 million in the median scenario, a material improvement compared to $764,000 for the growth-style index. Importantly, despite having greater short-term volatility than the MSCI USA Index, these would have yielded a greater account balance — $517,000 compared to $358,000 — in the worst 20-year period. Although past results are not a guarantee of future returns, this demonstrates how the high average returns, and low long-horizon risk of the American Funds growth-objective strategies could have helped mitigate the risk of insufficient appreciation.

Now consider a retiree seeking 5% annual withdrawals (adjusted for inflation) for 20 years, from a $1 million nest egg. The chart on the right below calculates asset balance from investing in the MSCI USA index, compared to MSCI USA Value style index, and AF Growth and Income objective strategies, at the end of 20 years. As before, we evaluate every rolling 20-year period from 1977 – 2016. In the median scenario, the growth and income-objective strategies would have preserved a balance of $462,000. This would have exceeded the median account balance for both the MSCI USA Index ($393,000), and the MSCI USA Value Index ($337,000). As before, the objective-based strategies could have produced superior outcomes even in the worst 20-year period. This demonstrates how the low volatility, and low downside capture of American Funds growth and income-objective strategies could have helped mitigate the risk of capital erosion in retirement

View fund expense ratios and returns.

Objective-based investing can fit in traditional portfolio construction practice

Advisors can readily incorporate principles of objective-based investing to align risk-based portfolios to client goals. While asset allocation typically specifies the amount of equities, based on the client’s risk tolerances, advisors can specify investment objectives to also align the type of equities to client goals.

For example, advisors typically recommend the same 60/40 stock-bond portfolio to all clients with a moderate risk tolerance, irrespective of goal or life stage. An objective-based lens would instead suggest that a worker saving for retirement may have a greater focus on appreciation, and therefore invest the equities in growth-objective strategies. In contrast, a retiree with the same risk tolerance might have a greater focus on income, and therefore emphasize equity strategies that seek growth and income. This would preserve the same proportion of stocks and bonds, while seeking to align portfolio characteristics with client needs.

Advisors can also use a style-box lens to evaluate how objective-based funds fit with the rest of their line up, and evaluate diversification across funds. Objective-based funds may span style boxes, and have flexibility to move. However, flexibility itself can be an important advantage and most changes tend to be gradual and measured. As a result advisors can use objective-based funds as a core holding in client portfolios, and still largely match desired style-box diversification.

Finally, investment objectives like appreciation or income are more intuitive to clients, and easier to understand. While the role of mid-cap value or hedged-Japan equity might be confusing, a retiree might readily follow why his or her portfolio includes income strategies. Clients who understand their portfolios better may in turn be motivated to save more, spend prudently and stay invested longer. This combination of potentially improved investment results and improved client behavior can be an irresistible force towards improved client outcomes.

View fund expense ratios and returns.

Investment results assume all distributions are reinvested and reflect applicable fees and expenses.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

Higher yielding, higher risk bonds can fluctuate in price more than investment-grade bonds, so investors should maintain a long-term perspective.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Past results are not predictive of results in future periods.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Our latest insights

-

-

Economic Indicators

-

Demographics & Culture

-

Emerging Markets

-

RELATED INSIGHTS

-

Portfolio Construction

-

Portfolio Construction

-

Portfolio Construction

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Sunder Ramkumar

Sunder Ramkumar