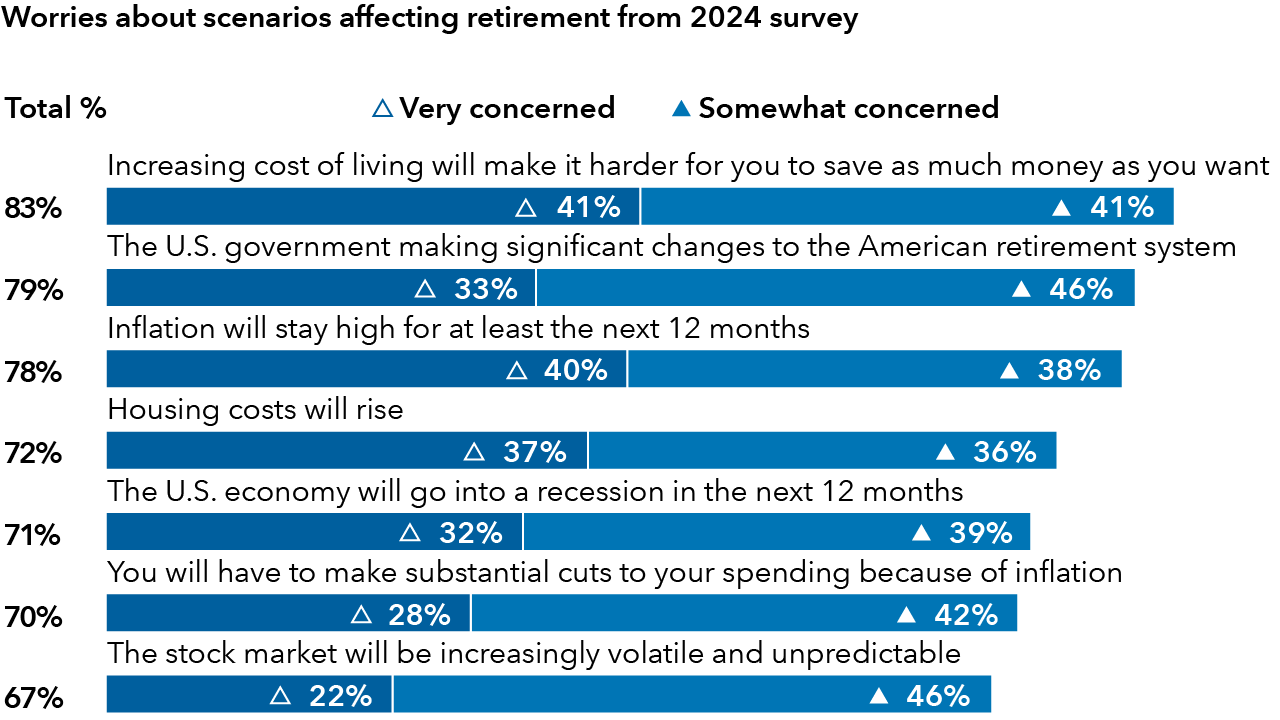

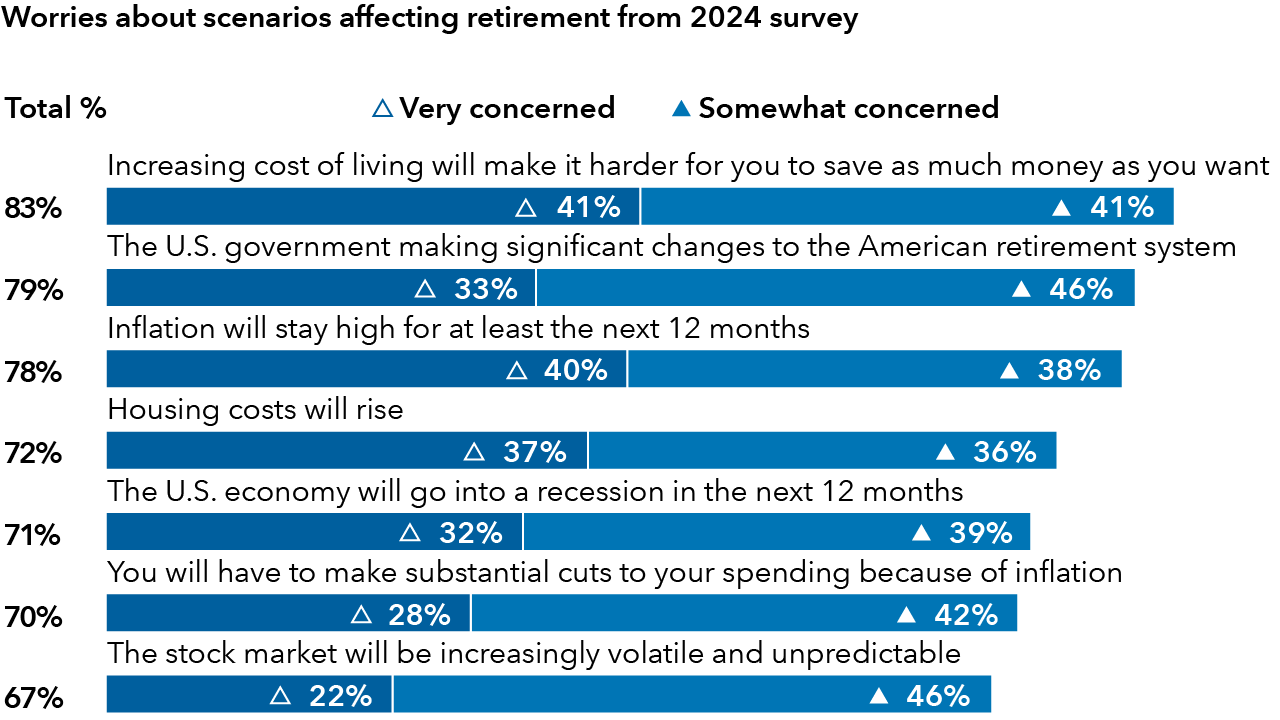

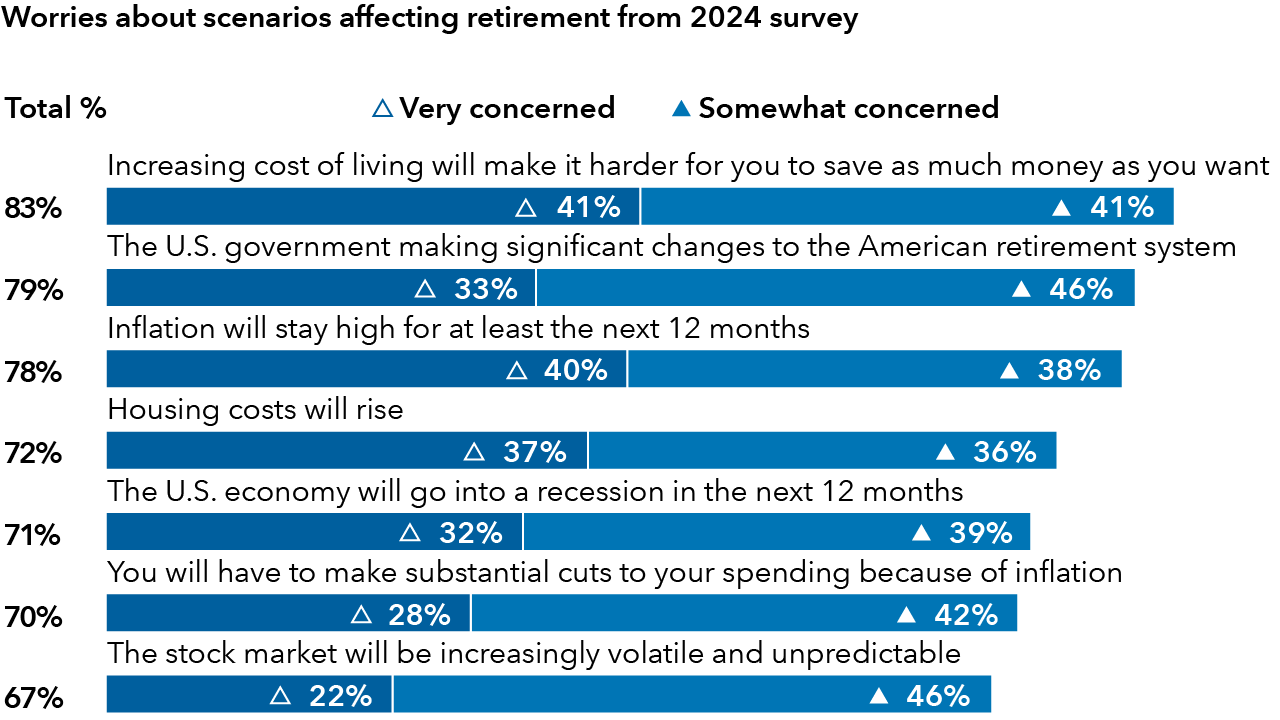

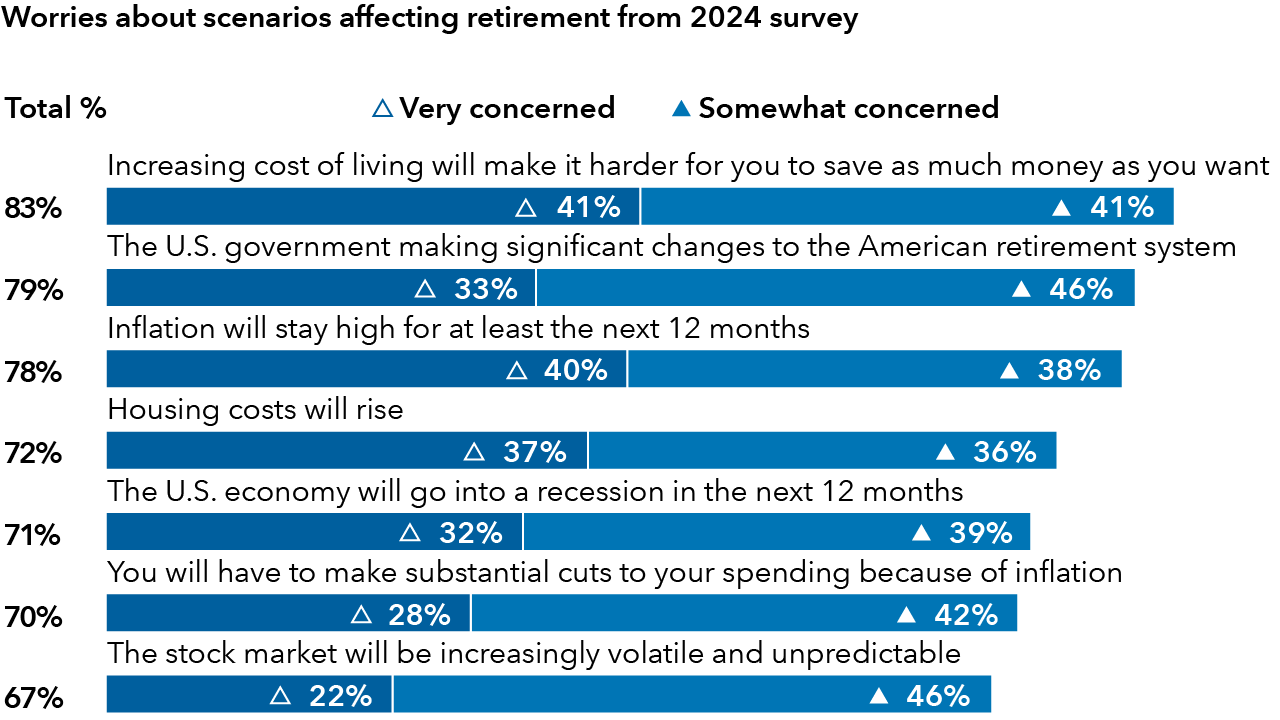

Capital Group’s Portfolio Consulting and Analytics team has met with thousands of advisors to understand challenges in retirement income portfolios while also drawing from independent research about investor preferences in retirement. From these conversations, they’ve found that many investors are living longer, retiring sooner than expected and prefer higher withdrawal amounts in the early stages of retirement. Yet, at the same time, some of the biggest concerns on investors’ minds in 2024 are inflation risk to retirement income and market unpredictability as well as sustainable income.

July 26, 2024

5 MIN ARTICLE

KEY TAKEAWAYS

- Inflation, market volatility and sustainable income remain top-of-mind concerns for investors when it comes to retirement

- Advisors may want to fine tune asset allocation for retirement income portfolios

- Among other considerations, equity allocations can help mitigate inflation while dividends can help reduce volatility and drawdown risk

“Many advisors we work with are grappling with the reality of what’s needed to meet client retirement goals, especially in the current environment,” says Casey Dregits, senior portfolio consultant on the Capital Group Portfolio Consulting and Analytics team. “Many advisors think about adjusting equity and fixed income allocations in retirement income portfolios but don’t necessarily fine tune their exposures to address unique needs and risks for retirement income,” Dregits adds.

How might advisors think about balancing current market risks with investor needs and wants for retirement? Here are some asset allocation ideas we recommend advisors think about when building retirement income portfolios that can weather market shifts for the long term.

Consider different types of dividends and active fixed income exposure to manage inflation

Most investors are worried about inflation risk and the potential for different market scenarios, according to an EBRI survey from early 2024. “Income portfolios are often expected to provide resilience during times of market uncertainty and a level of spending power protection as life expectancy increases,” says Multi-asset Investment Director Mario DiVito.

Sources: Employee Benefit Research Institute (EBRI), Greenwald Research. The Retirement Confidence Survey measures worker and retiree confidence about retirement, and is conducted by the Employee Benefit Research Institute (EBRI) and Greenwald Research. The 2024 survey of 2,521 Americans was conducted online January 2 through January 31, 2024. All respondents were ages 25 or older. The survey included 1,255 workers and 1,266 retirees – this year included an oversample of 721 completed surveys among military individuals (298 workers and 423 retirees). Data were weighted by age, sex, military status, household income, and race/ethnicity. Unweighted sample sizes are noted on charts to provide information for margin of error estimates. The margin of error would be ± 2.8 percentage points for workers, ± 2.8 retirees, and ± 3.7 for military respondents in a similarly sized random sample. Please note percentages in the chart may not total to 100 due to rounding and/or missing categories. Any trend changes or differences in subgroups noted in text are statistically significant; if no trend changes are noted, there were no significant differences.

Sources: Employee Benefit Research Institute (EBRI), Greenwald Research. The Retirement Confidence Survey measures worker and retiree confidence about retirement, and is conducted by the Employee Benefit Research Institute (EBRI) and Greenwald Research. The 2024 survey of 2,521 Americans was conducted online January 2 through January 31, 2024. All respondents were ages 25 or older. The survey included 1,255 workers and 1,266 retirees – this year included an oversample of 721 completed surveys among military individuals (298 workers and 423 retirees). Data were weighted by age, sex, military status, household income, and race/ethnicity. Unweighted sample sizes are noted on charts to provide information for margin of error estimates. The margin of error would be ± 2.8 percentage points for workers, ± 2.8 retirees, and ± 3.7 for military respondents in a similarly sized random sample. Please note percentages in the chart may not total to 100 due to rounding and/or missing categories. Any trend changes or differences in subgroups noted in text are statistically significant; if no trend changes are noted, there were no significant differences.

Turn device sideways for larger view

Equity allocations in retirement income portfolios can be designed to provide longer term inflation protection. “Investments in dividend growers especially can be a way to keep up with inflation. This includes diversified exposure to high dividend payers and dividend growers across sectors and regions,” DiVito says.

“In bonds, we balance the roles of fixed income in retirement income portfolios to help provide capital preservation, equity diversification and opportunistic exposure to higher-yielding assets, while being mindful of inflation protection,” DiVito adds.

As an example, the team recently sought to diversify sources of inflation protection in retirement income model portfolios and reduced dedicated longer duration inflation-protected bond exposure. “We wanted to balance the potential drawdown risk of higher duration inflation-protected bonds with higher interest rate sensitivity while ensuring we have some inflation protection,” says Samir Mathur, who chairs Capital Group’s Portfolio Solutions Committee (PSC). “We are allocating to more flexible bond funds in our retirement income portfolios, which have the ability to dynamically invest in Treasury Inflation-Protected Securities if the opportunity arises,” Mathur adds.

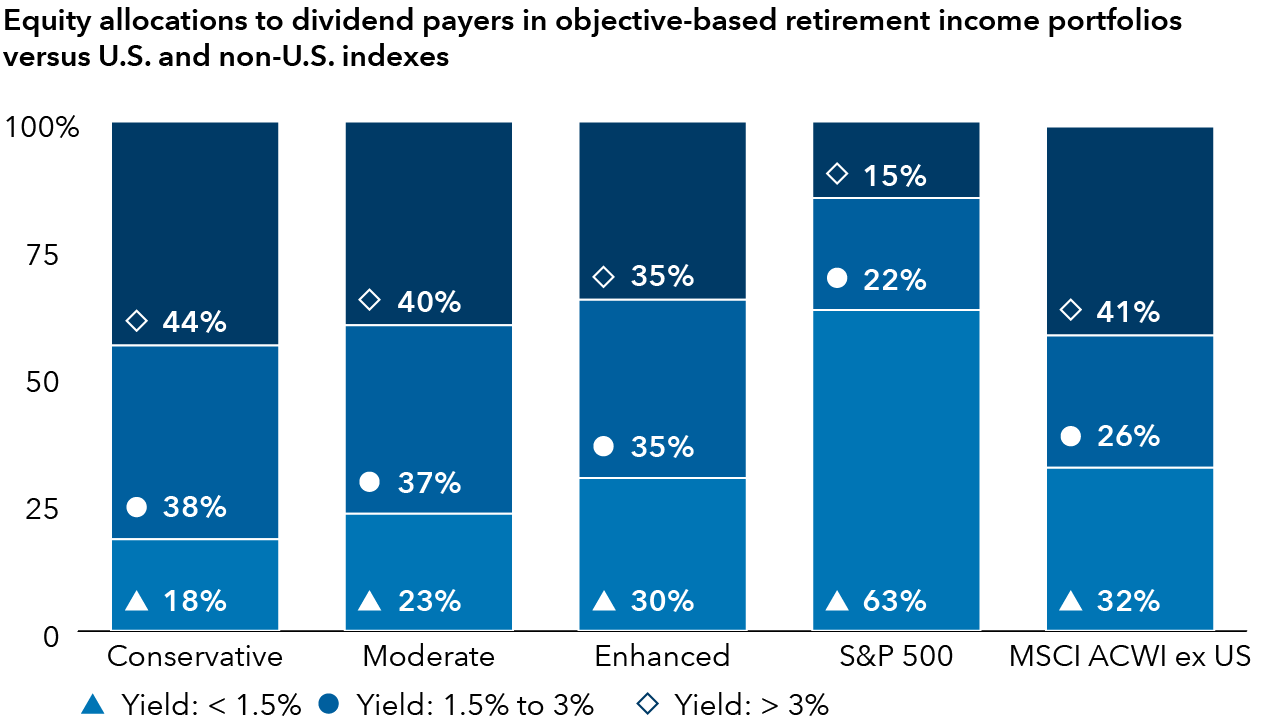

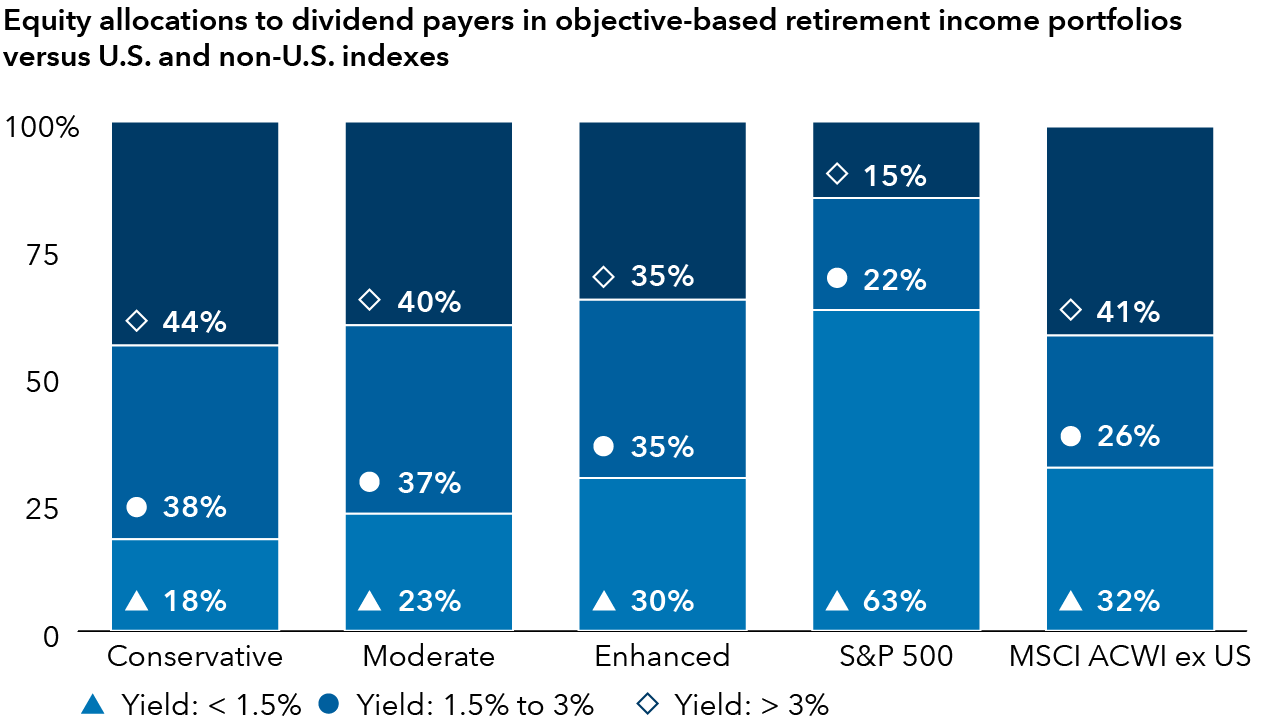

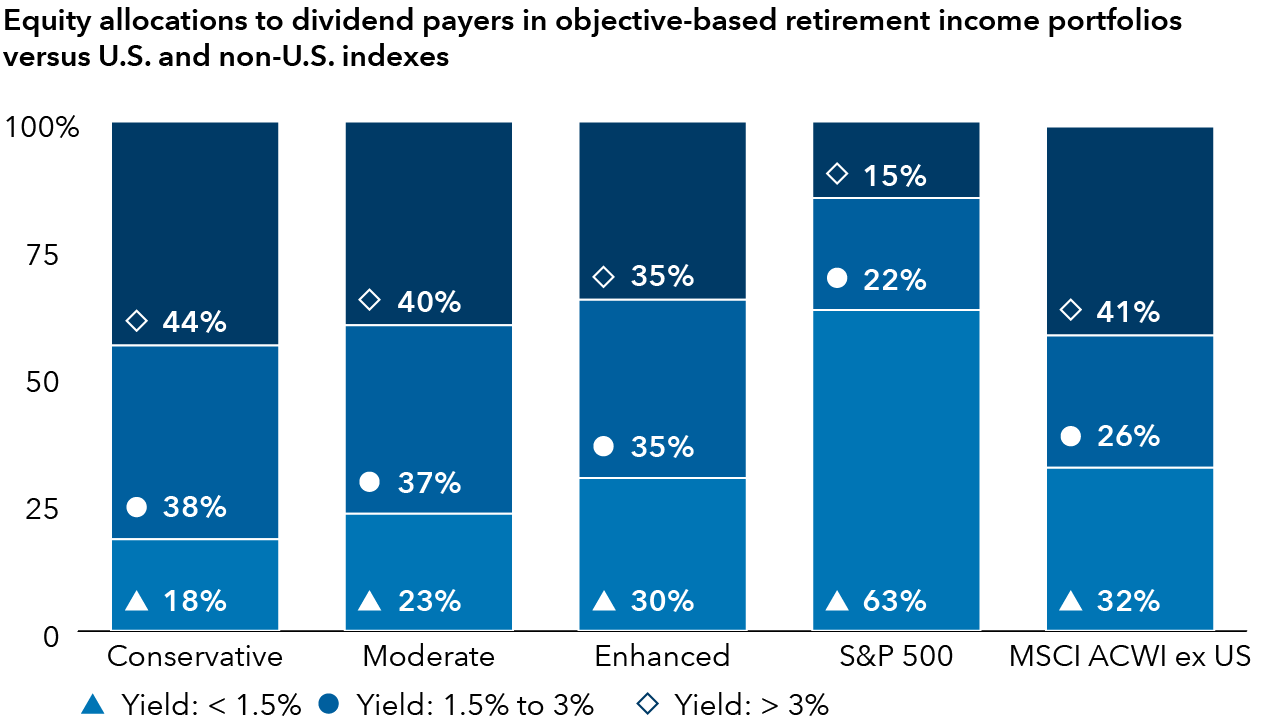

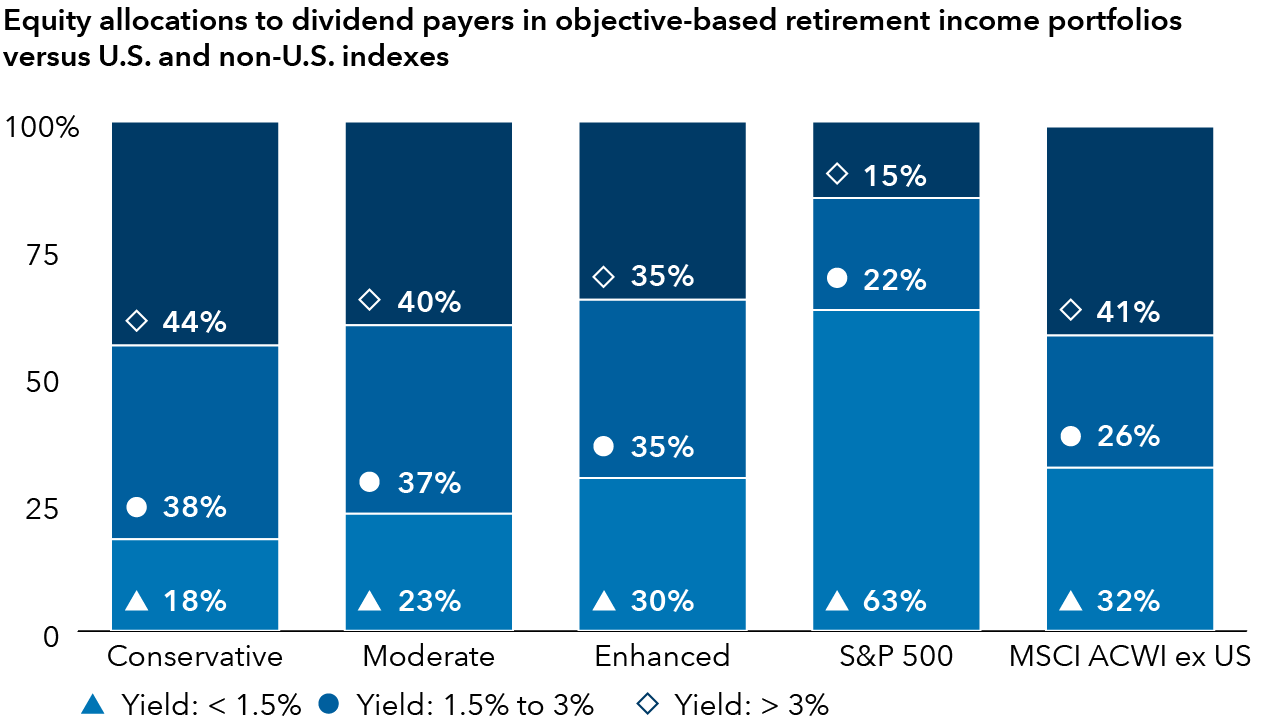

Increase exposure to dividend-focused equities to mitigate volatility

The possibility of market declines late in investors’ working years or early retirement is a big risk. “Managing big drawdowns is especially crucial, given the potential for market volatility and different economic scenarios,” Dregits says.

“Limiting portfolio drawdown and volatility are among the key success metrics for our income-oriented portfolios,” DiVito says. One question advisors might ask is whether client portfolios have adequate exposure to dividend payers to help mitigate potential market volatility.

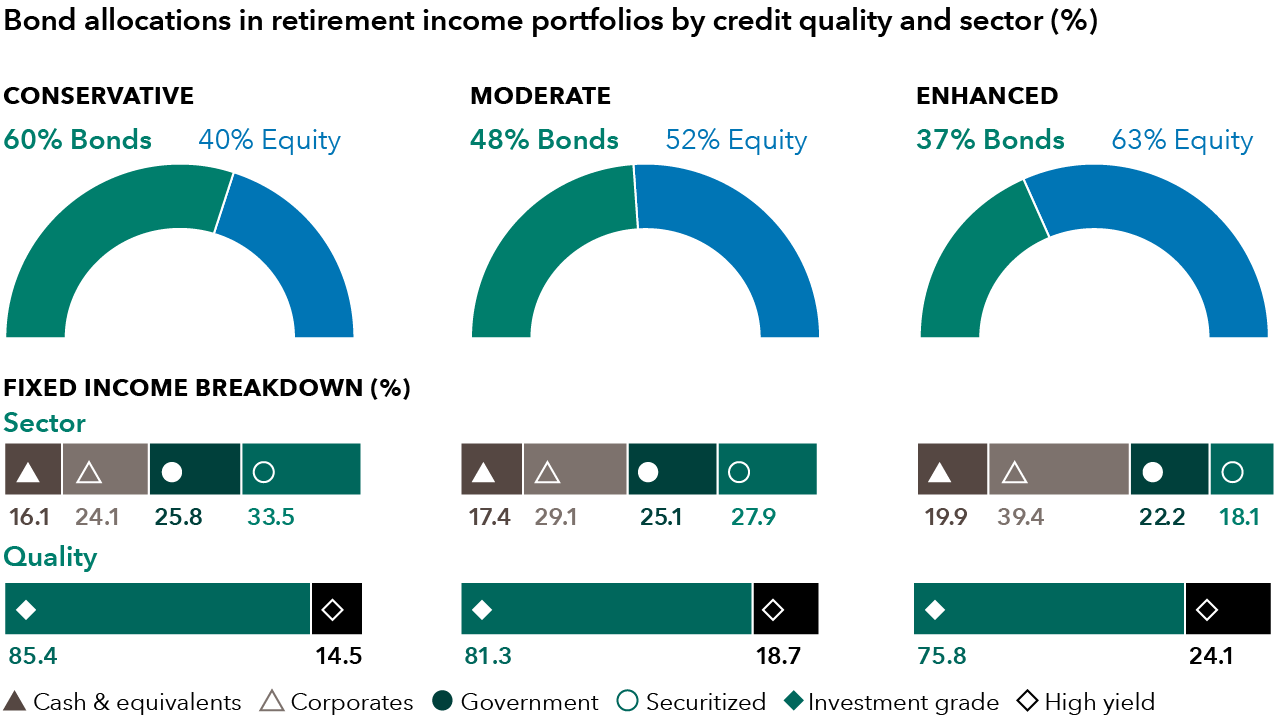

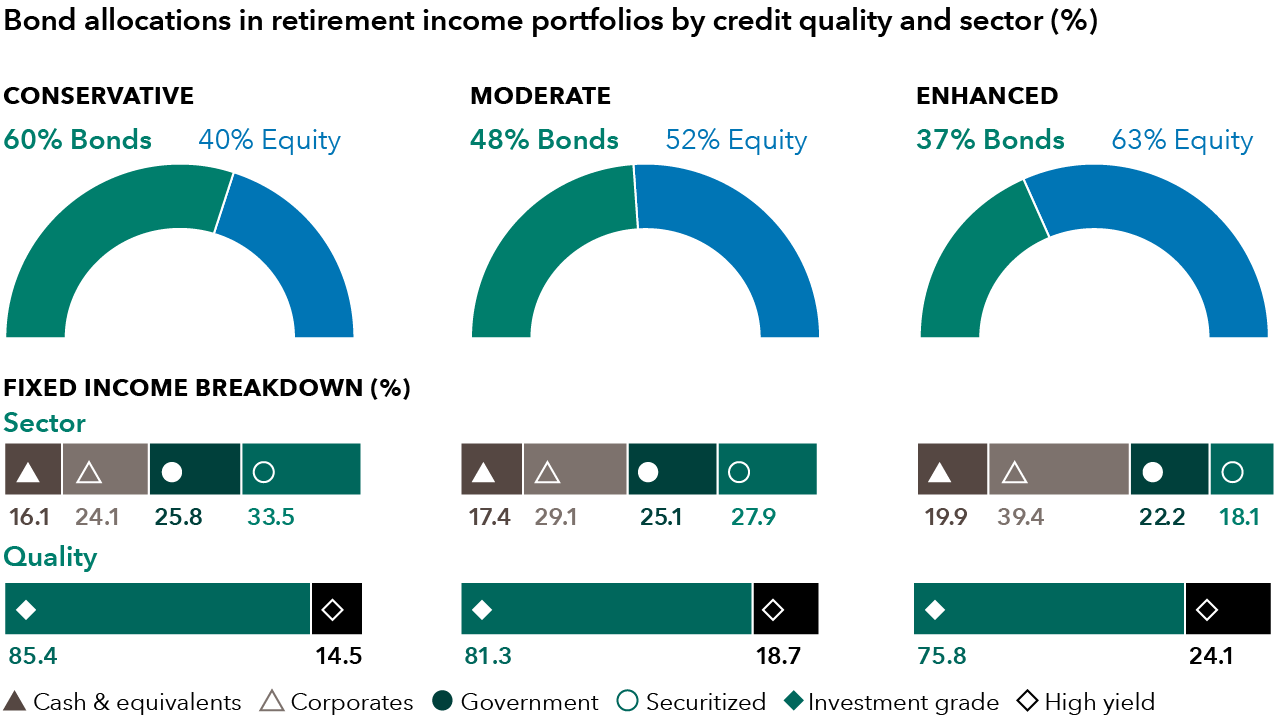

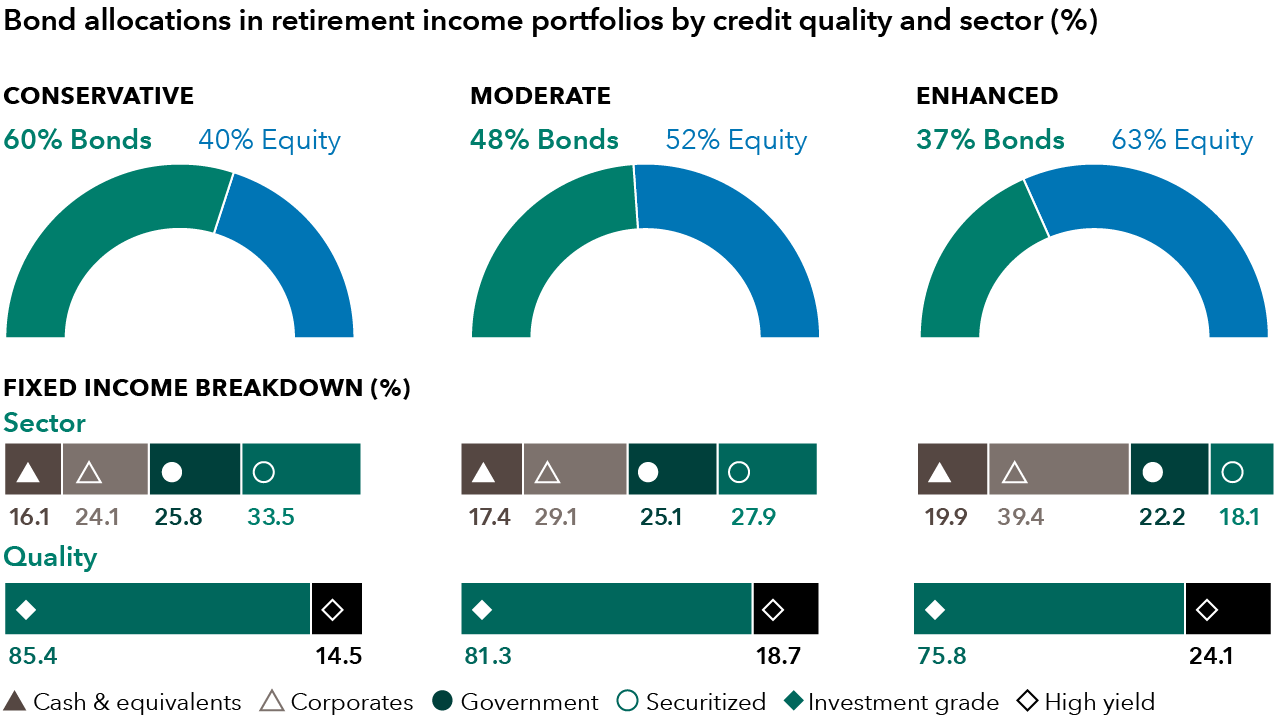

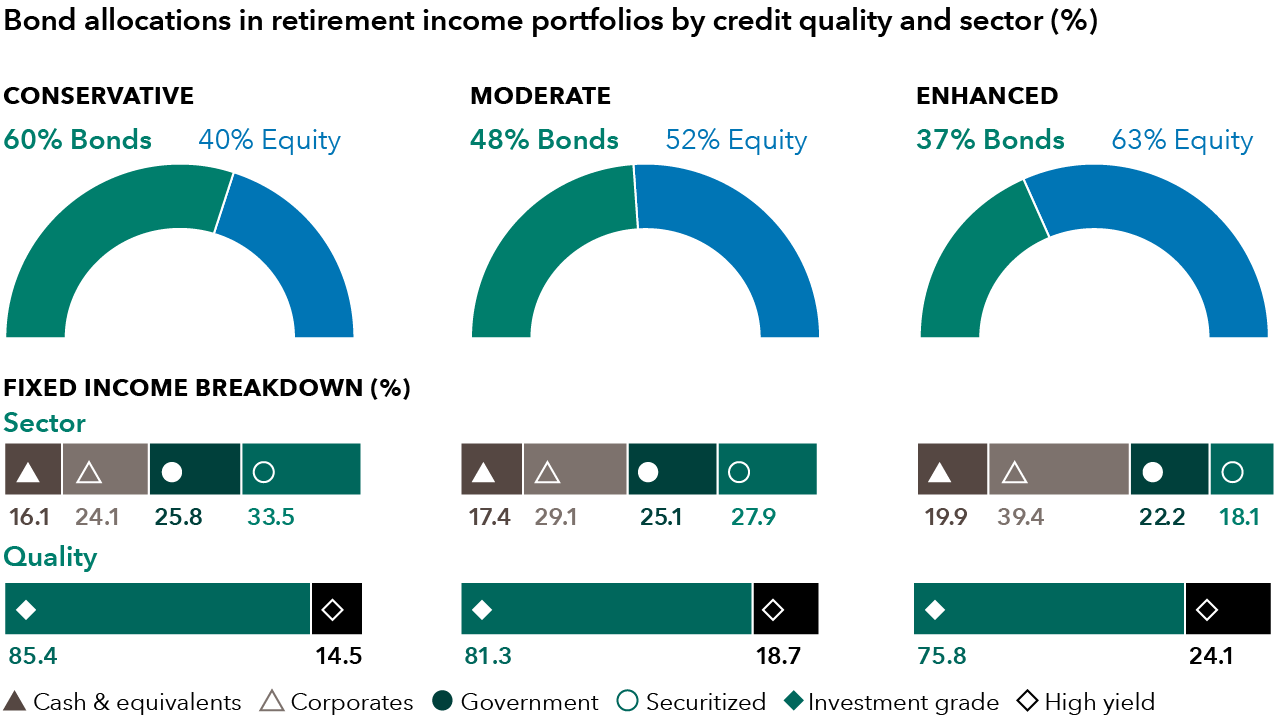

Source: Capital Group as of March 31, 2024. Totals may not reconcile due to rounding. The Conservative portfolio is represented by American Funds Retirement Income Model Portfolio - Conservative while the Moderate and Enhanced portfolios are represented by the American Funds Retirement Income Model Portfolio - Moderate and American Funds Retirement Income Model Portfolio - Enhanced, respectively.

Source: Capital Group as of March 31, 2024. Totals may not reconcile due to rounding. The Conservative portfolio is represented by American Funds Retirement Income Model Portfolio - Conservative while the Moderate and Enhanced portfolios are represented by the American Funds Retirement Income Model Portfolio - Moderate and American Funds Retirement Income Model Portfolio - Enhanced, respectively.

Turn device sideways for larger view

Dividends are a crucial, long-term feature in retirement income portfolio construction. “We actively monitor underlying fund allocations in our portfolios based on ongoing research and recently increased exposure to both high dividend payers and dividend growers outside the U.S.,” Mathur says. Our research has shown that non-U.S. equities have had better valuations, as measured by price-to-earnings ratios, and higher dividend yields relative to the U.S.,” Mathur adds.

Consider a mix of growth equities and diversified higher yielding bonds to support sustainable withdrawals over time

What’s realistic depends upon investors’ particular preferences and circumstances and what trade-offs they’re willing to make. “We think it’s important to build diversified portfolios with varying levels of equity and fixed income to support sustainable income for investors based on their specific goals,” DiVito says.

Source: Capital Group as of March 31, 2024. Totals may not reconcile due to rounding. The Conservative portfolio is represented by American Funds Retirement Income Model Portfolio - Conservative while the Moderate and Enhanced portfolios are represented by the American Funds Retirement Income Model Portfolio - Moderate and American Funds Retirement Income Model Portfolio - Enhanced, respectively. High yield allocations include companies with a below investment grade debt rating (BB and below).

Source: Capital Group as of March 31, 2024. Totals may not reconcile due to rounding. The Conservative portfolio is represented by American Funds Retirement Income Model Portfolio - Conservative while the Moderate and Enhanced portfolios are represented by the American Funds Retirement Income Model Portfolio - Moderate and American Funds Retirement Income Model Portfolio - Enhanced, respectively. High yield allocations include companies with a below investment grade debt rating (BB and below).

Turn device sideways for larger view

Advisors may want to vary bond allocations in retirement income portfolios based on goal.

The PSC recently increased allocations to flexible bond funds in retirement income models to support portfolio yield – another key success metric in retirement income portfolios. (The PSC makes decisions with input from the Capital Solutions Group, including research, analysis and portfolio monitoring.) Flexible bond funds can access opportunities across regions, sectors and credit quality. “We don’t strive to maximize current yield in our retirement income model portfolios but seek to provide a balance of current income and capital appreciation to sustain longer term goals and address the complex risks of retirees,” Mathur says.

Eighty-three percent of workers in the 2024 EBRI survey indicated that they were interested in purchasing an annuity for the retirement savings, while 28% of actual retirees currently use annuities as a source of income. “It’s common for advisors to ask about guaranteed income products and supplementing with capital appreciation-oriented mutual funds and ETFs in client portfolios to support higher withdrawal rates,” Dregits says. We encourage advisors to speak with our portfolio construction team about tradeoffs relative to their specific circumstances and goals.

Want to talk about fine tuning retirement income allocations for your clients’ goals? Sign up for an in-depth portfolio review and analysis with Capital Group

Casey Dregits is a senior portfolio consultant with 22 years of investment industry experience. He holds an MBA as well as bachelor’s degree in political science, history, and Germanic studies from Indiana University. He also holds the Chartered Financial Analyst® designation.

Mario DiVito is a multi-asset investment director with a focus on model portfolios and target date services. He has 35 years of investment industry experience. He holds an MBA from DePaul University and a bachelor’s degree in finance from Loyola University.

Samir Mathur is a solutions portfolio manager with 31 years of investment industry experience. He chairs Capital Group’s Portfolio Solutions and Global Solutions Committees. He also serves on the Target Date Solutions and Custom Solutions committees. He holds an MBA from University of California, Berkeley, a master’s degree in computer science from University of Southern California and a bachelor’s of technology degree from the Indian Institute of Technology, Delhi.