Broaden menus with flexible global exposure without excessive volatility

DEFINED CONTRIBUTION FOCUS FUNDS

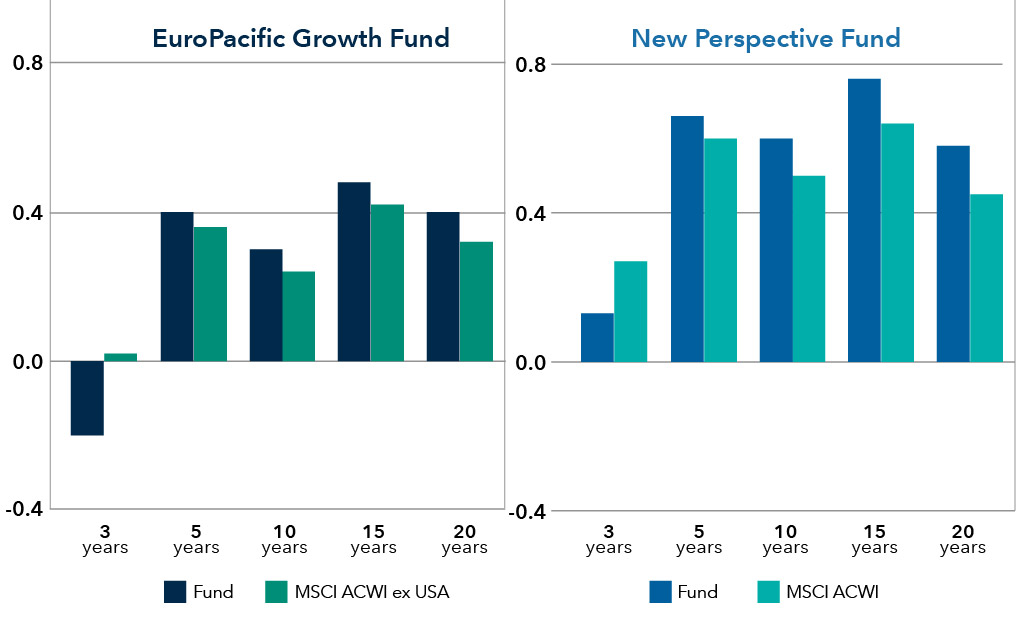

Higher returns with lower volatility than benchmarks

EuroPacific Growth Fund® and New Perspective Fund® both have had favorable risk-adjusted results compared to their benchmarks.

Sharpe ratios indicate excess return per unit of risk (figures as of December 31, 2023)1

Sources: Capital Group, Morningstar. Sharpe ratio is calculated by using standard deviation and return in excess of the risk-free rate to determine reward per unit of risk. The higher the Sharpe ratio, the better the portfolio’s historical risk-adjusted performance.

Standard deviation: Annualized standard deviation (based on monthly returns) is a common measure of absolute volatility that tells how returns over time have varied from the mean. A lower number signifies lower volatility.

Risk-free rate: A theoretical interest rate on a single-period loan that has zero probability of default.

INTERNATIONAL EQUITY FOCUS FUNDS

-

-

EuroPacific Growth Fund

An opportunistic approach to international investing

- Invests primarily in companies of any size in Europe and the Pacific Basin.

- Employs deep fundamental research to identify opportunities for capital appreciation.

- Aims to identify companies with sound management and sustainable competitive advantages instead of focusing on countries or regions.

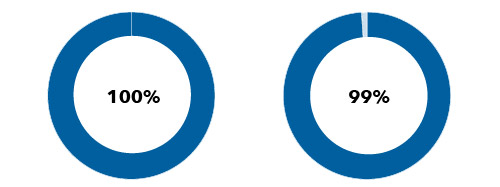

Over rolling monthly 10-year periods through 2023, the fund has frequently outpaced its benchmark index and peer average.*

Percentage of rolling periods in which:

Fund outpaced index:

Fund outpaced peers:

241 out of 241

239 out of 241

Rolling monthly 10-year periods

Morningstar

Medalist RatingTM of Gold†Analyst-driven 100%

Data coverage 100% -

New Perspective Fund

-

INSIGHT & RESOURCES

Find the right investments

* Rolling monthly 10-year periods for the past 30 years, ending December 31, 2023. The fund’s benchmark index is the EuroPacific Growth Fund Historical Benchmarks Index. EuroPacific Growth Fund Historical Benchmarks Index returns reflect the results of the MSCI EAFE® Index through 03/31/2007 and the MSCI All Country World ex USA Index, the fund’s current primary benchmark, thereafter. MSCI EAFE® (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization weighted index that is designed to measure developed equity market results, excluding the United States and Canada. MSCI All Country World ex USA Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global developed and emerging markets, excluding the United States. The index consists of more than 40 developed and emerging market country indexes. Results reflect dividends net of withholding taxes. These indexes are unmanaged, and their results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. The Morningstar category from EUPAC inception until September 2014 was Foreign Large Blend and Foreign Large Growth thereafter.

† As of July 10, 2024 (EUPAC), and June 24, 2024 (NPF), based on Class R-6 shares.

§ Rolling monthly 10-year periods over the fund's lifetime through December 31, 2023. The fund’s benchmark index is the MSCI All Country World Index (ACWI), a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes. The MSCI ACWI Index began after the fund’s inception. From March 13, 1973, through December 31, 1987, the MSCI World Index was used. MSCI World Index is a benchmark for “world” or “global” stock funds and is intended to represent a broad cross-section of global markets. Results reflect dividends net of withholding taxes. Fund peers are represented by Morningstar World Large Stock. Morningstar World Large Stock category portfolios have few geographical limitations. It is common for these portfolios to invest the majority of their assets in the U.S., Europe and Japan, with the remainder divided among the globe’s smaller markets. These portfolios typically have 20%–60% of assets in U.S. stocks. The Morningstar category average includes all share classes for the funds in the category. While American Funds Class R-6 shares do not include fees for advisor compensation and third-party service provider payments, the share classes represented in the Morningstar category have varying fee structures and can include these and other fees and charges resulting in higher expenses and lower results than American Funds Class R-6 shares.

** Source: Morningstar, "The Thrilling 36" by Russel Kinnel, August 20, 2024. Morningstar's screening took into consideration expense ratios, manager ownership, returns over manager's tenure, and Morningstar Risk, Medalist and Parent ratings. The universe was limited to share classes accessible to individual investors with a minimum investment no greater than $50,000, did not include funds of funds, and must be rated by Morningstar analysts. Class A shares were evaluated for American Funds. Visit morningstar.com for more details.

Unless otherwise indicated, data is as of December 31, 2023, and fund data is for Class R-6 shares.

Capital Group did not compensate Morningstar for the ratings and comments contained in this material. However, the firm has paid Morningstar a licensing fee to access and publish its ratings data. The payment of this subscription fee does not give rise to a material conflict with Morningstar.

- Class R-6 shares were first offered on 5/1/2009.

- Calculated by Morningstar. Due to differing calculation methods, the figures shown here may differ from those calculated by Capital Group.