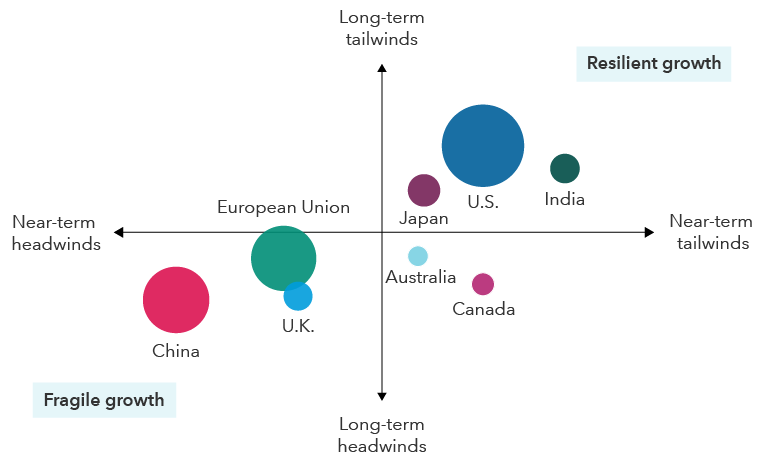

The United States, flexing its muscles as the world’s largest economy, is once again serving the critical role of global growth engine. As Europe and China struggle with weak economic activity, the U.S., India and, to a lesser extent, Japan are showing signs of resilience as the major players in the world economy diverge.

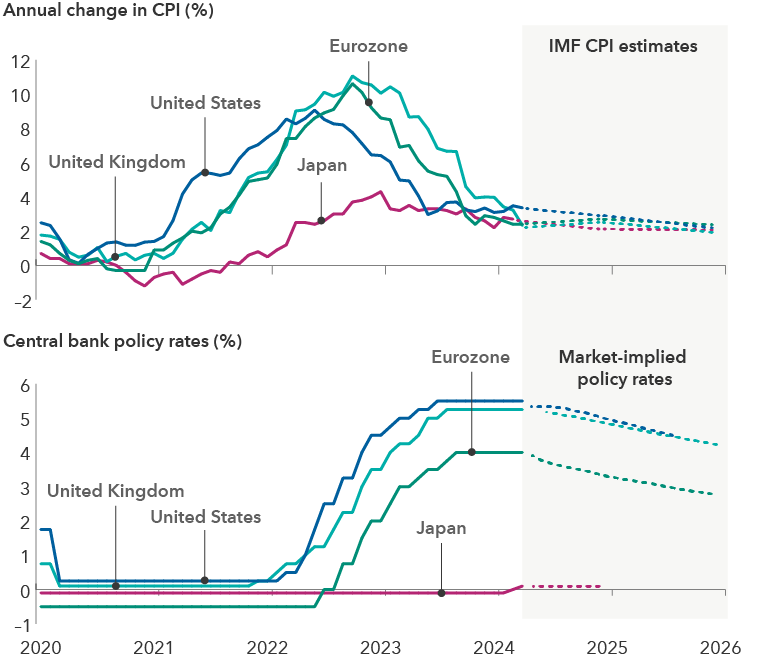

Despite higher interest rates and elevated inflation, the International Monetary Fund is predicting the U.S. economy will expand this year at more than twice the rate of other major developed countries. The IMF recently raised its forecast for U.S. growth to 2.7%, compared to 0.8% for Europe. Moreover, the power of America’s consumer-driven economy is helping to support growth in the rest of the world as well.

“People used to say if the U.S. sneezes, the rest of the world catches a cold. The opposite can also be true,” says Capital Group economist Darrell Spence. “When it’s firing on all cylinders, the U.S. can help other export-oriented economies.”