Will the gains hold? It’s uncertain given China’s historically volatile stock market. Recent developments underscore China’s policy cycle is moving in a more positive direction. The government has become more vocal in its support of innovative private companies. That’s a shift from late 2020 to 2021, when the private sector faced regulatory scrutiny, sparking a broad sell-off and a crisis of confidence among entrepreneurs, domestic consumers and investors.

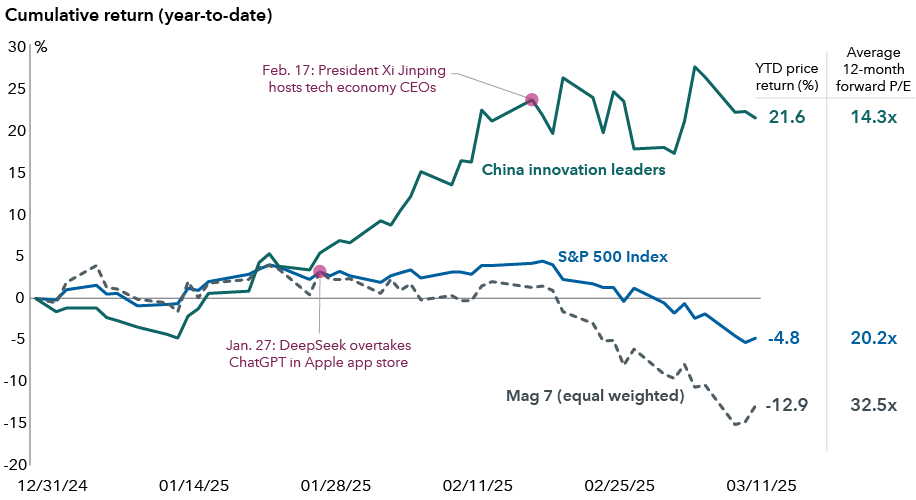

The sharp move up for the MSCI China Index is also reminder that innovation is global and select growth opportunities can be discovered in non-U.S. markets.

Going forward, potential gains for China’s equity market are likely to be more differentiated, as investors gauge which companies will see greater earnings revisions. Our investment analysts, for instance, don’t think certain internet platform companies are expensive, even after the rally, due to the potential for better margins and re-accelerating revenue.

Consensus expects 8% earnings growth for the MSCI China Index in 2025, led by areas within technology and consumer industries, based on FactSet estimates as of March 6. The risk is that profit projections get revised lower — a pattern we’ve seen in recent years due to China’s economic slowdown and lack of big-bang stimulus the market has hoped for.

There are also downside risks to economic growth. Fresh U.S. tariffs on Chinese goods and technology-related sanctions could weigh on certain companies. Domestic consumption also remains subdued. And while home sales in large cities picked up in January and February, the ailing property market is far from healed.