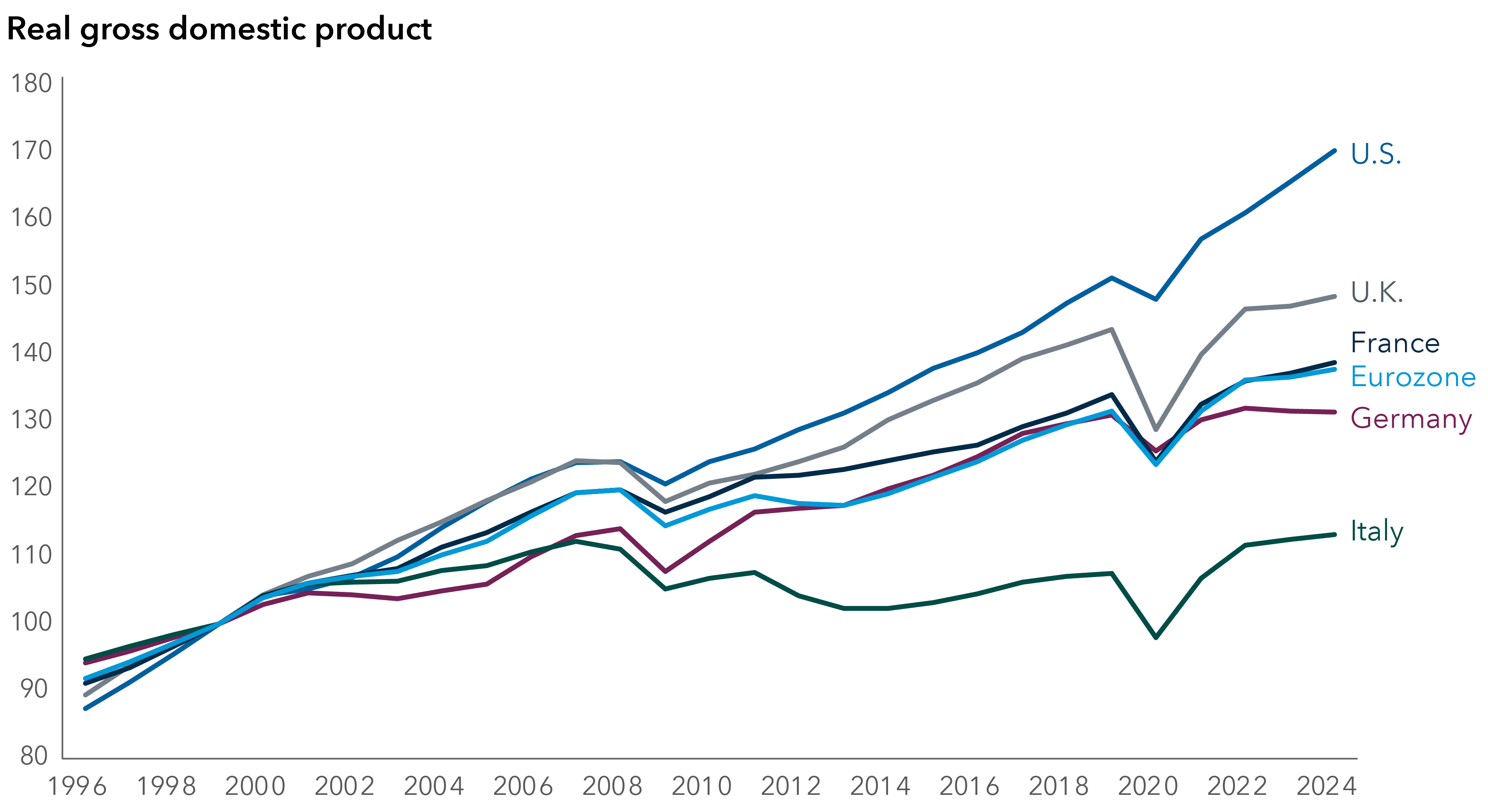

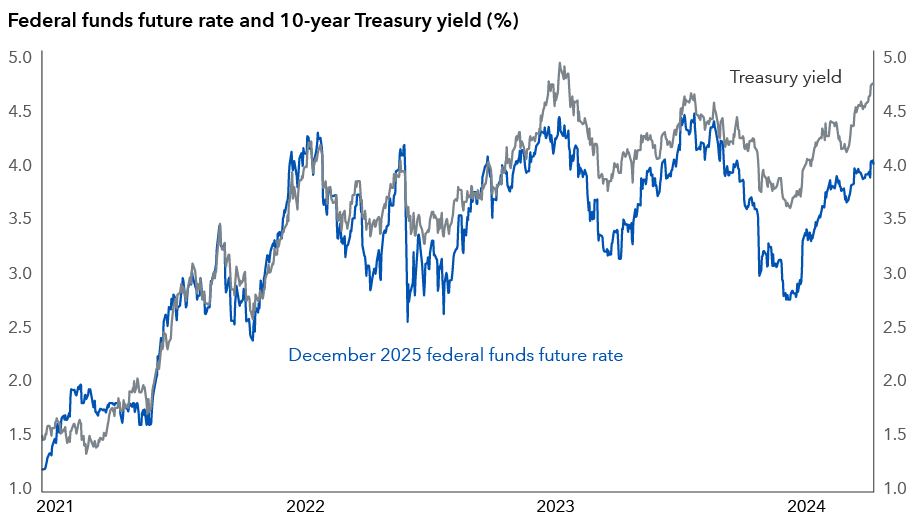

Market consensus for Europe in 2025 is cautious, with expectations of a modest pick-up in growth after subdued growth in 2023 and 2024, a gradual easing of inflation toward or below central banks’ 2% target, and policy interest rates to fall by 100 basis points (bps) in both the eurozone and the U.K. There is a concern that higher U.S. tariffs could undermine European economic growth.

“On inflation, market consensus expectations are for softer labor markets and tighter fiscal policy to pull down services inflation,” suggests Europe economist Robert Lind. “We are more cautious on the potential drop in inflation. Inflation could be slower to return to central banks’ 2% targets.”

The resilience of services inflation so far has confounded expectations. Despite clearer signs that the labor market is softening, there is yet to be strong evidence that wage growth is returning to levels consistent with 2% inflation. A reversal in core goods disinflation – perhaps prompted by higher tariffs – could mean progress on inflation stalls or even reverses.

“The challenge for Europe’s central banks will be how to weigh sluggish growth against stickier inflation. We think they are likely to focus on growth weakness to justify rate cuts in early 2025, but inflation worries will constrain the scope of easing later in the year,” says economist Beth Beckett.

Beckett is also keeping a close eye on the U.K., where households are consuming fewer goods than they did in 2019 and at the same time paying higher prices for them. “While shifts in demand during the pandemic explain some of this, trade barriers resulting from Brexit are also having long-term negative impacts on consumption and prices,” Beckett said. “Higher goods prices are likely to complicate the Bank of England’s efforts to return inflation to their 2% target on a sustainable basis, especially considering stubborn services-sector inflation.” In addition, investors are becoming more nervous about the U.K.’s fiscal trajectory, which has triggered higher bond yields and a weaker pound.

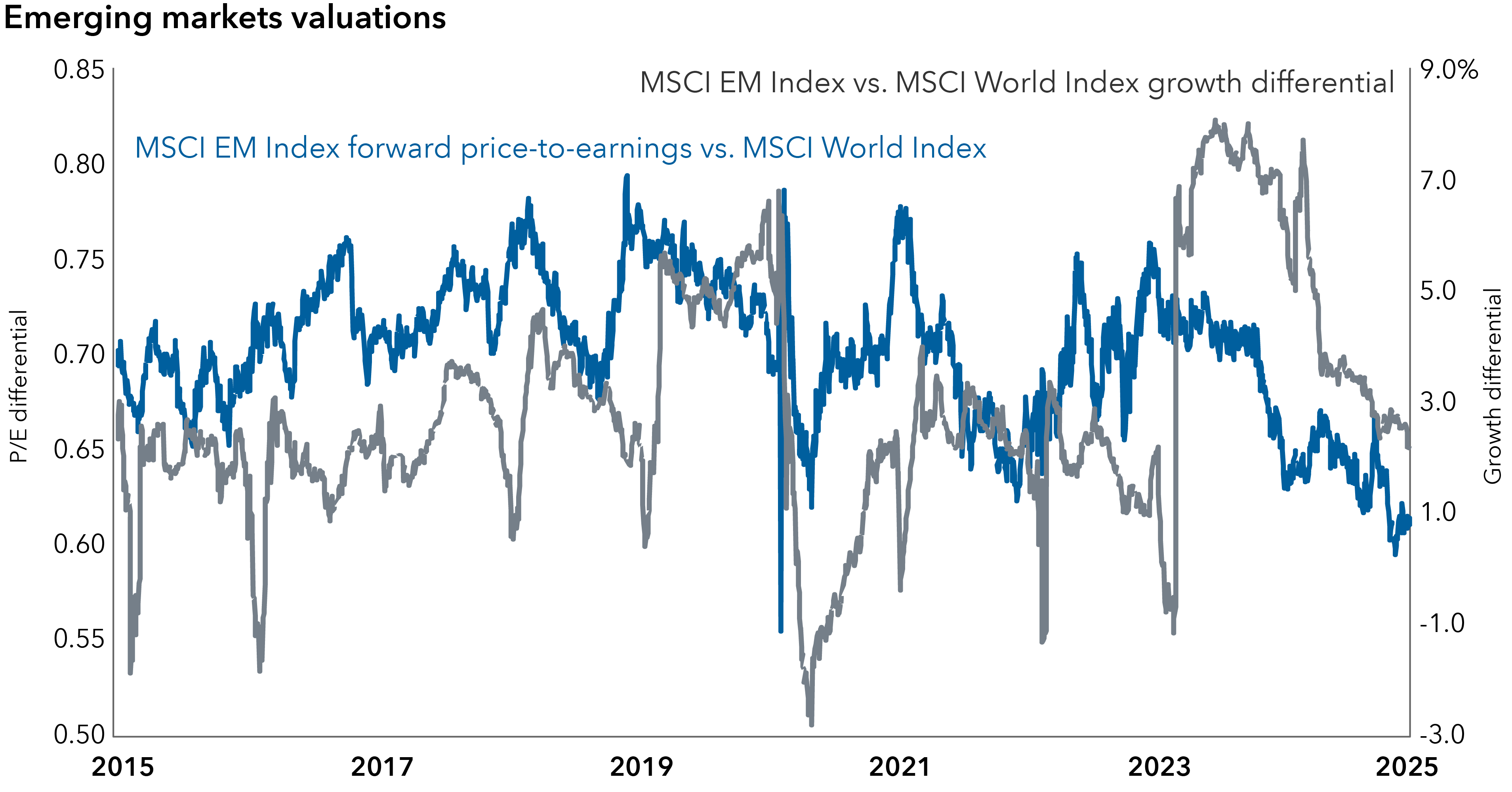

Moreover, risks to equity market forecasts are asymmetric. “The sentiment and valuation gap between the U.S. and European markets appears stretched,” Lind said. “We think there is greater potential for European equity returns to catch up with the U.S., either in a ‘risk-off’ drawdown in U.S. equities or on a rotation into cheaper European equities.”