According to a new book, Playing with Reality by neuroscientist Kelly Clancy, humans have been playing games for almost 10,000 years — they predate written language. Games are key to understanding our nature, not only because they are fun, but because they can serve as a simplified model for how our minds work.

“Uncertainty is a significant part of what makes any game enjoyable,” Clancy writes. By linking external rewards to humans’ internal motivation to understand, games allow humans to “explore and enjoy uncertainty in a nonthreatening way,” she explains. The brain rewards itself for making good decisions by releasing dopamine.

If the expected reward of making a good prediction is large enough, Clancy writes, “Humans can be motivated to behave over arbitrarily long timescales.” For example, children can be motivated to remain on their best behavior for months in anticipation of Santa’s arrival at Christmas time.

The idea of waiting a long time for a large reward also applies to retirement planning. Saving for retirement requires discipline, patience and the foresight to set aside money for the future. It can be frustrating for financially stressed participants to think about saving more for retirement, especially if they feel that they are not making enough progress or that they are missing out on other opportunities. It can be difficult to resist the temptation of spending that money on immediate gratification or short-term needs.

Using gamification to offer relatively small rewards could be enough to help move a participant to action. As part of the SECURE 2.0 Act of 2022, employers can now offer small financial incentives up to $250 to employees to encourage them to contribute to a retirement plan. Prior to the SECURE 2.0 Act, employers couldn’t provide incentives for participating in the plan besides matching contributions. It is not clear whether someone other than the employer — such as a plan’s financial professional or recordkeeper — could provide these incentives to plan participants. However, future guidance is expected from the Internal Revenue Service (IRS) on this issue.

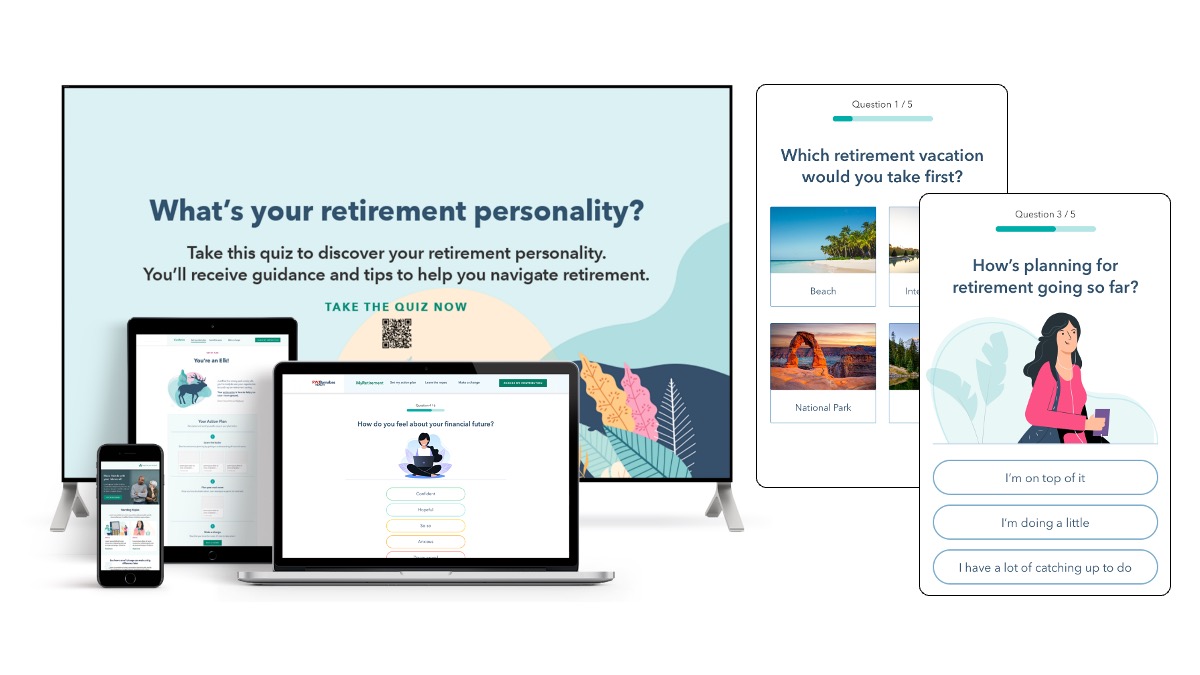

Introducing elements of gamification into retirement planning can help participants overcome negative emotions they may have about saving by providing them with positive feedback, rewards and achievements to make them feel good about putting money aside for retirement.