Step 4: Share opportunities

Finally, discuss potential action steps with the client. Some common wealth planning ideas might include:

Reviewing cash reserves. Look at emergency funds to ensure clients have enough to cover expenses without being forced to close out positions at a loss.

Roth conversions. Market declines may present an opportunity to convert traditional IRA assets to Roth accounts at lower prices, potentially reducing the tax impact.

Trust strategies. Review whether clients might benefit from grantor retained annuity trusts (GRATs), swapping provisions or other trust mechanisms to take advantage of current market conditions.

Tax-loss harvesting. You might capture tax losses from positions that have declined for some investors, offsetting future capital gains.

Some ideas for their portfolios might include:

Portfolio rebalancing. For some clients, consider increasing allocations to quality assets that are oversold.

Increasing contributions. Consider contributing more to retirement and college savings accounts, taking advantage of lower prices to make progress toward long-term goals.

Dollar-cost averaging. For clients with cash on the sidelines, they might systematically invest during market declines to acquire more shares at lower prices without having to perfectly time the market.

Defensive positioning. In the current environment, investors might benefit from quality companies with strong balance sheets, domestic revenue streams and pricing power.

Conversation starters:

- “Is there anything you feel strongly that you should do right now?”

- “Would you like to discuss some strategic moves we might consider in this environment?”

- “Do these events make you think differently about how much risk you can stomach or how much you want on hand in cash reserves?”

- “Is there any part of your portfolio you've been wanting to adjust that this market environment might make more favorable?”

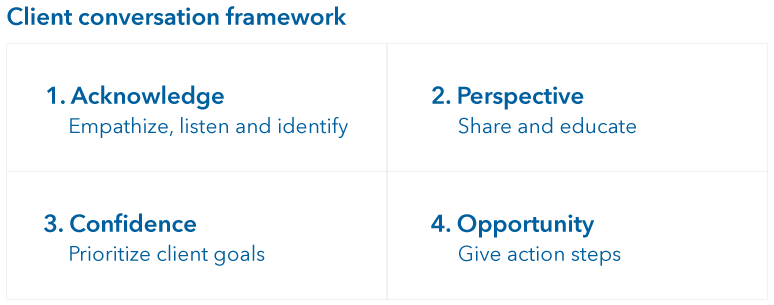

Tariff-related volatility presents a unique opportunity to demonstrate your value as an advisor. This four-box framework gives you a structured approach to these conversations. While each client's situation is unique, this methodology adapts to individual needs while ensuring you cover essential elements of effective communication during market disruptions. That enables you to turn adversity — what began as a moment of anxiety and confusion — into an opportunity to refocus clients on their goals, deepen your relationships with them and reaffirm your value.