Adding retirement plans to your wealth management practice can help grow your business. More than that, it can be a manageable commitment.

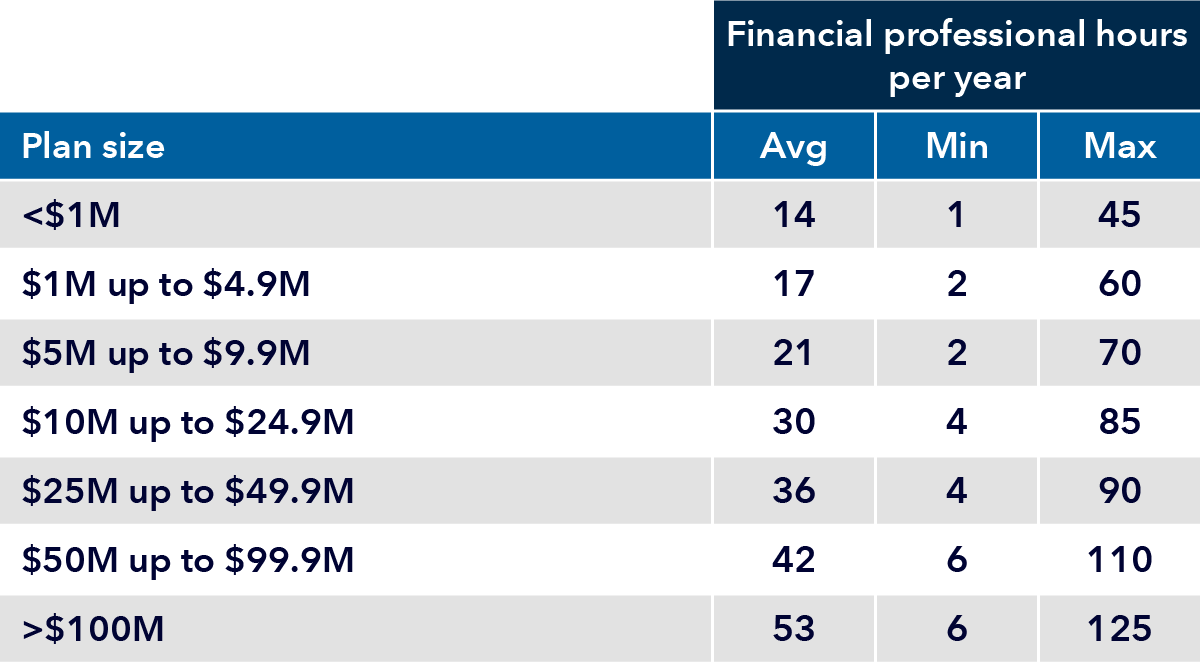

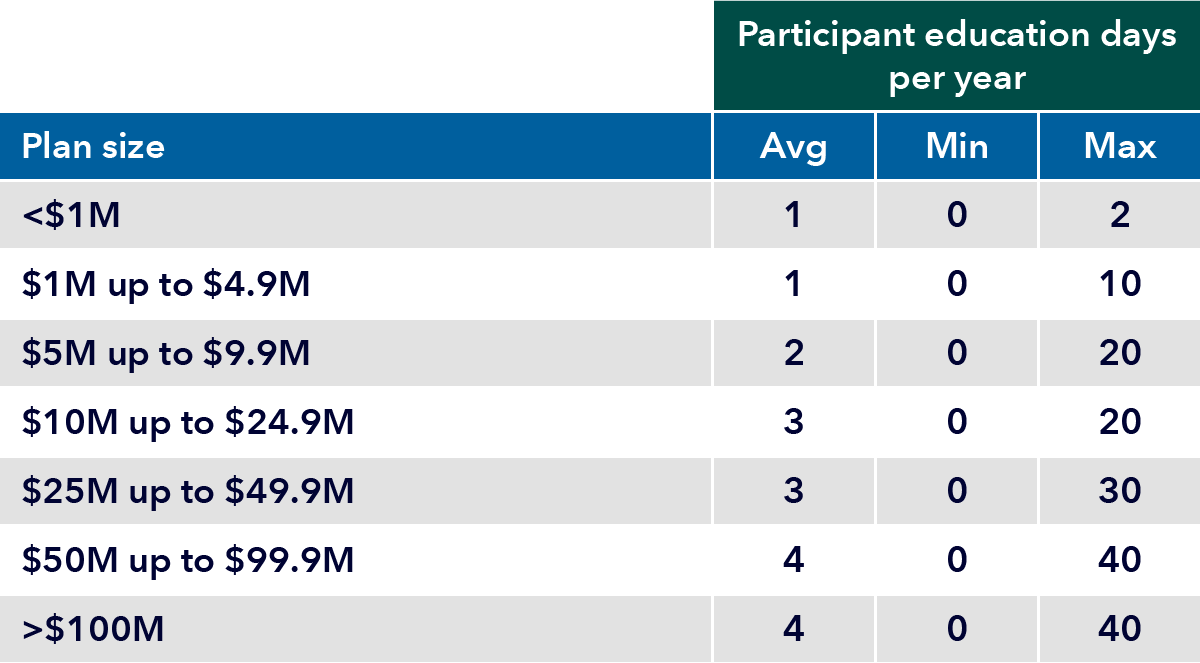

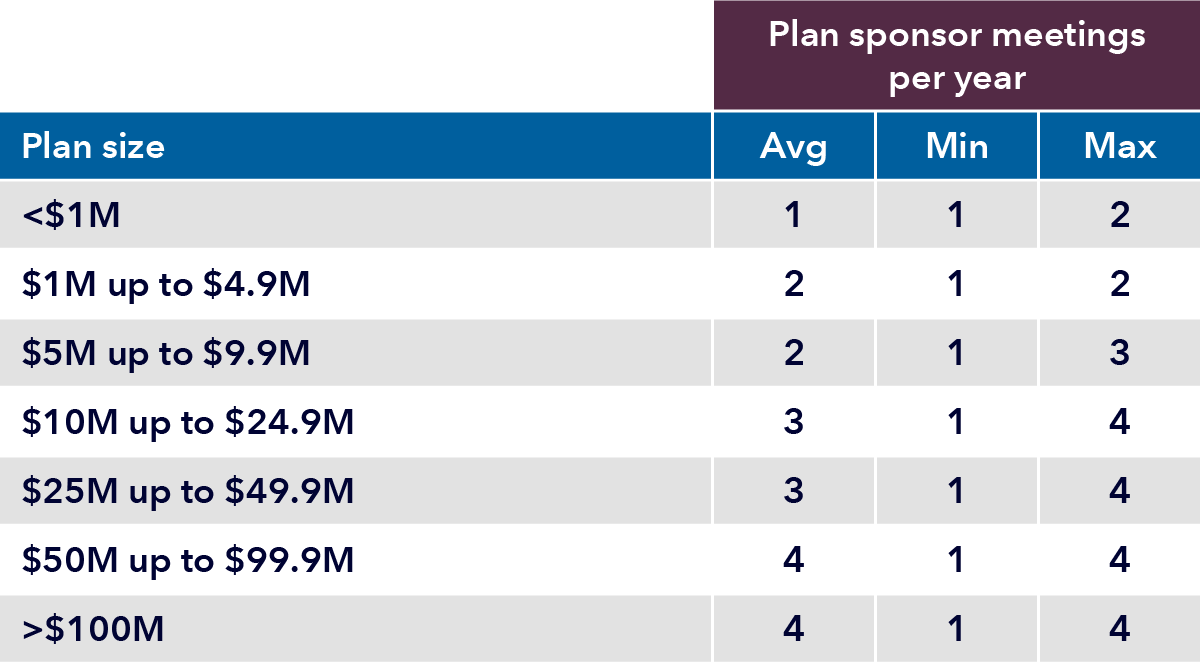

A 2024 WinMore Plans survey of 84 practices with at least 50% of revenue from retirement or a dedicated retirement plan business shows the average amount of time spent by financial professionals on plans annually. If you’re considering adding more plan business to your practice, take a look at what you might expect.